More precision in hedging your exposure means less cost for you. Don't miss our newly introduced Weekly Options on Euro-Bund Futures which complement our standard Euro-Bund Options (OGBL) offering.

What are Weekly Options on Euro-Bund Futures?

Weekly Options are options with an expiry on every Friday that is not already a monthly Euro-Bund Option expiry. Like regular monthly Eurex Euro-Bund Options, Weekly Options are physically settled into the next corresponding Euro-Bund Futures maturity.

Which weekly expiries will be available?

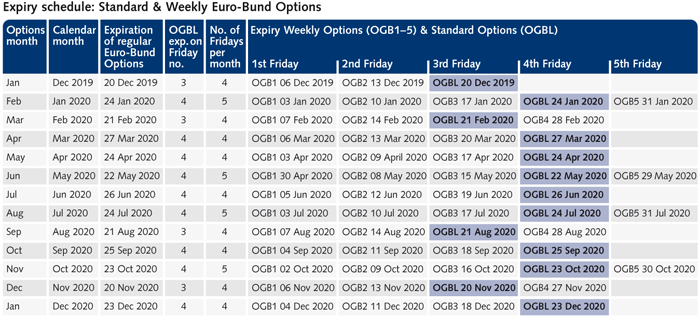

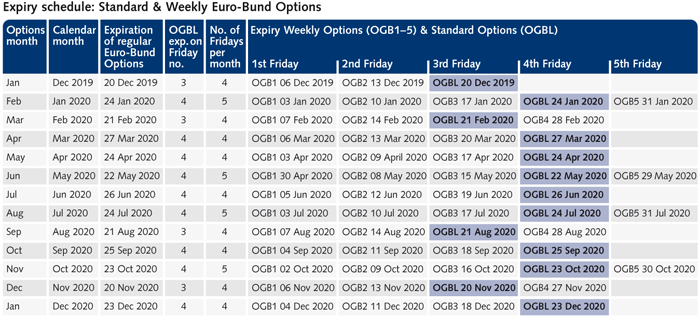

The first five weekly expiries will be available. The third or fourth Friday of each month will remain expiration day for standard options series (OGBL), so no Weekly Option series will be available on this expiry date. Eurex Exchange is using the product codes OGB1, OGB2, OGB3, OGB4 and OGB5 to denote the first, second, third, fourth and fifth weekly expiries of the calendar month.

What happens if Friday is not an exchange day?

If a Friday is not an exchange day, then the exchange day preceding the Friday shall be the last trading day. If the preceding trading day is not within the same calendar month as the Friday of the expiration week, the last trading day shall be the trading day immediately succeeding the Friday of the expiration week.

The following table provides an overview of all standard options (OGBL) and all Weekly Options (OGB1-5) expirations in 2018:

What time do the Weekly Options expire?

Weekly Options on Euro-Bund Futures are American-style: An option can be exercised until the end of the Post-trading Full Period (18:00 CET on the last trading day) on any exchange day during the lifetime of the option.

Key benefits:

- Weekly options will offer more targeted opportunities to trade specific high impact events such as key economic announcements.

- Provide users with increased flexibility in managing option positions.

- Traders can engage in option strategies (e.g. diagonal spreads) by pairing weekly and monthly Euro-Bund options.

- Reduced margin requirements through cross margining with regular options and futures positions.