OTC Clear Procedures Support

Overview of content

- Trade Transfer

- Account Transfer

- Portfolio Transfer

- Netting

- Package Clearing

- MtM Adjustment

Package Clearing

Download here the Package Clearing Overview!

FAQ

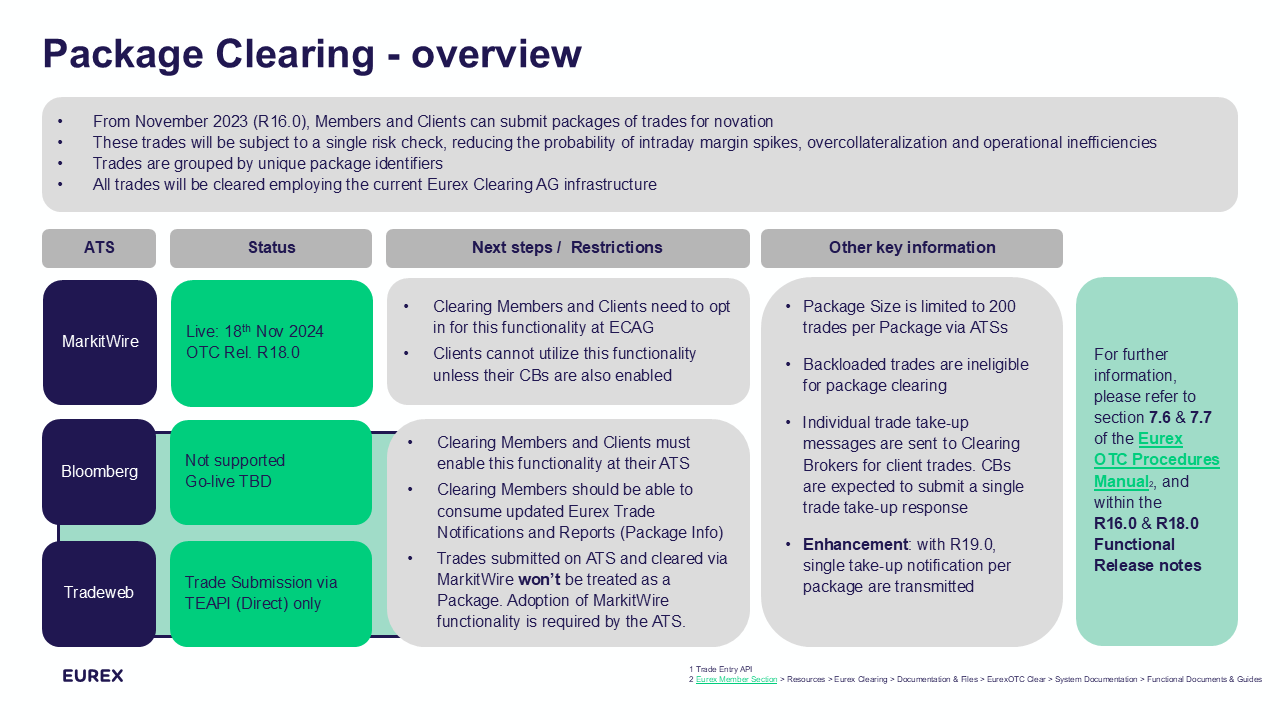

Yes, we offer Package Clearing for trades submitted from Markitwire, Bloomberg (via Trade Entry API (Direct)) and Tradeweb (via Trade Entry API (Direct)).

- Trades are grouped by unique Package Identifiers (called “Package ID” by Bloomberg and Tradeweb and “Linker ID” by MarkitWire).

- Package trades pass a single risk check to reduce the probability of intraday margin spikes, overcollateralization and operational inefficiencies.

- Trades are cleared under the All or Nothing principle.

- All trades linked together via a Linker ID and submitted for clearing via MarkitWire should be requested to be cleared under the same account at ECAG, while with Package Clearing via Bloomberg or Tradeweb (via Trade Entry API) the trades of the counterparty(ies) can be on the same or different accounts.

- MarkitWire: Individual trade take-up notifications will be sent for client trades submitted without a credit limit token, i.e. for client trades that did not go through a credit limit check prior to execution. Clearing Brokers are expected to submit a single trade take-up response using the FpML-API.

- Tradeweb via TEAPI (Trade Entry API) and Bloomberg via TEAPI (with planned go live in Q1 2025): Individual trade take-up messages are sent to Clearing Brokers for client trades. CBs are expected to submit a single trade take-up response using the FpML-API.

- The package size is limited to 200 trades.

- Backloading trades are ineligible.

- Trades submitted via MarkitWire which are executed over an Approved Trade Source (e.g. Bloomberg or Tradeweb) will not be cleared as package. In fact, additional MarkitWire fields to support the Approved Trade Resources (ATS) (and the consequent adoption of these new MarkitWire fields by the ATS and Eurex Clearing) would be needed.

- Individual trade take-up messages are sent to Clearing Brokers for client trades. Clearing Brokers are expected to submit a single trade take-up response. → Single take-up notification per package will be introduced with EurexOTC Release 19.0 (May 2025).

- Functionality is disabled per default.

- To enable Package Clearing please contact your dedicated Key Account Manager or client.services@deutsche-boerse.com.

- Clients cannot utilize this functionality unless their Clearing Brokers are enabled.

- No activation at Eurex is required.

- Clearing Members and Clients must enable this functionality at the respective Approved Trade Source.

Clients can only use Package Clearing in case their Clearing Member is also enabled.

- Both Package ID and Linker ID will be visible as well in the trade FpmL messages as in following member reports: Trade Novation Report (CI200, CB200), Trade Daily Summary Report (CI201, CB201), Full Inventory Report (CB202, CB207).

- The Linker ID will additionally be shown in the Incremental Risk Report (CI205, CB205).

- The Linker ID assigned to cleared trades submitted via MarkitWire will not be reported to the Trade Repositories by Eurex Clearing.

- Members can see the Package ID also in the EurexOTC Clear GUI. In the search result windows, the Linker ID will be reported in the Package ID column.

- EurexOTC Clear Procedures Manual section 7.6 and 7.7.

- Functional Release Notes of EurexOTC Clear Release 16.0 and 18.

Contacts

EurexOTC Helpdesk

Eurex Frankfurt AG

Key Account Management

Service times from 09:00 - 18:00 CET

Eurex Clearing AG | worldwide

Helpdesk Clearing Data Control

Service times from 08:00 – 20:00 CET

(no service on Saturday and Sunday)

T +49-69-211-1 24 53

Eurex Frankfurt AG

Customer Technical Support / Technical Helpdesk

Service times from Monday 01:00 – Friday 23:00 CET

(no service on Saturday and Sunday)

T +49-69-211-VIP / +49-69-211-1 08 88 (all)