18 Oct 2024

Eurex

€STR Futures - strong liquidity and margin efficiency in one place

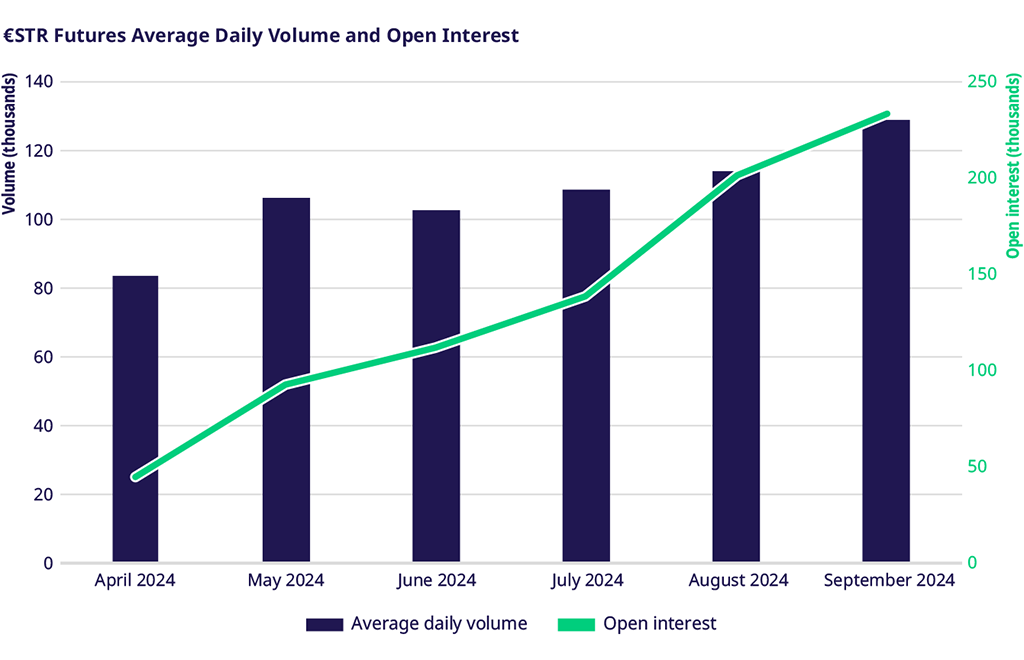

The €STR Futures continue to gain momentum; rising open interest and average daily volumes are clear indicators of growing market adoption. With these trends, Eurex customers benefit from deeper liquidity pools and more robust hedging options.

Beyond trading volumes and open interest, cross (product margining is crucial in enhancing efficiencies. By offsetting positions across Euro-denominated fixed income short-and long-term exchange-traded (ETD) and OTC derivatives at Eurex, market participants can reduce their margin requirements, reducing business funding costs.

Find out how these factors shape the €STR Futures and what they mean for trading strategies.

Rising Open Interest / Average Daily Volume:

|

|

43% | Monthly average daily volume growth in the last 6 months. |

55% | YTD market share of 55%. |

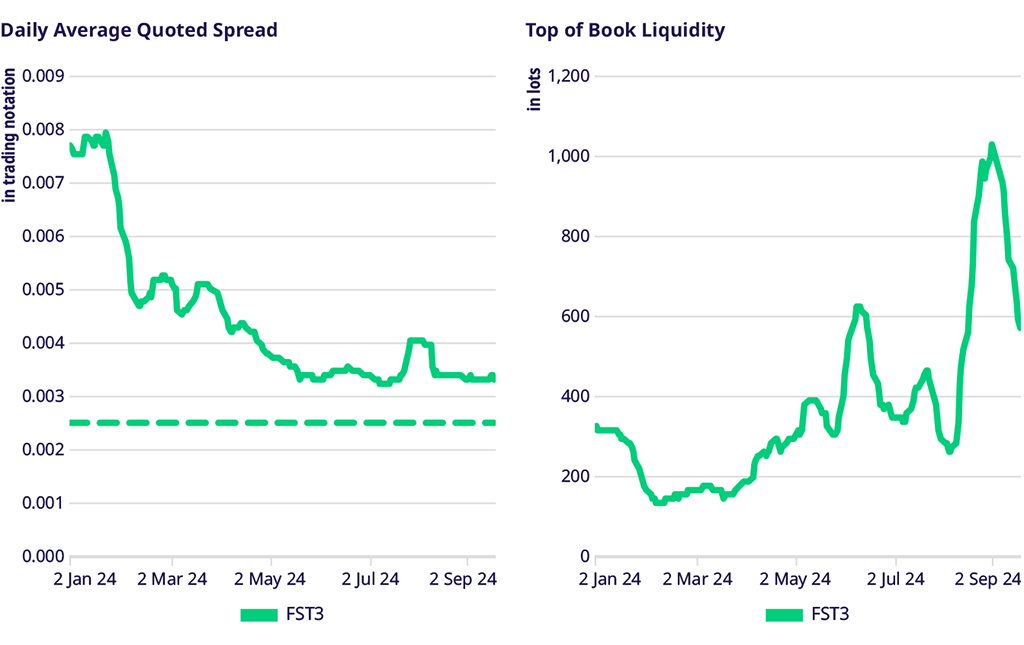

Top of book liquidity:

Quoted spreads in €STR Futures have significantly improved, now averaging below two ticks. Top of book liquidity has increased by +100 lots since February 2024 and +300 lots since April, allowing the CLOB to accommodate larger trades. Visible order book liquidity has also seen notable improvements.

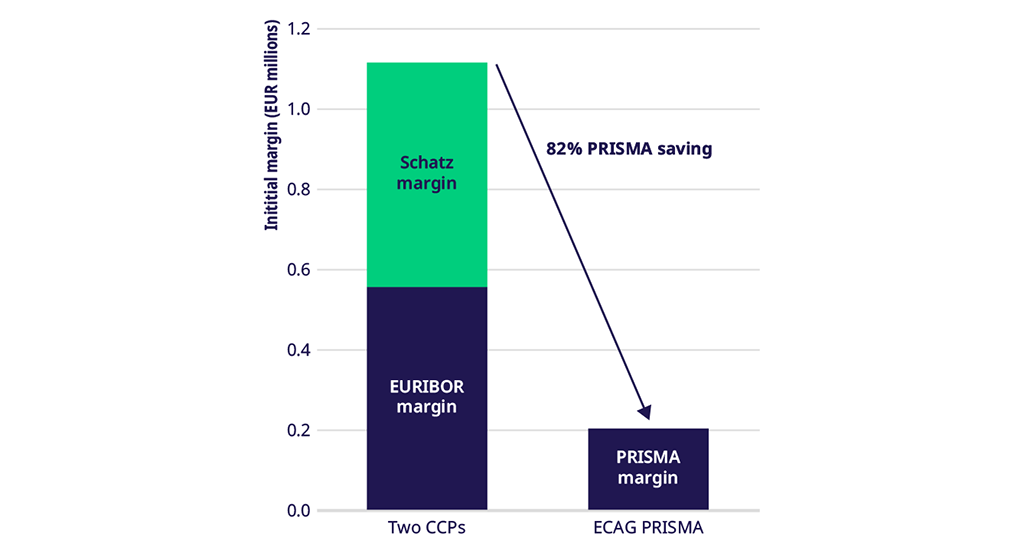

Cross Product Margining Benefits:

Eurex offers TED Spreads as an off-book functionality in the form of EFP trades with margining benefits of ~82% when both legs are cleared through Eurex.

*In compliance with regulations, margin savings are capped at 80%, the exceedance is charged via supplementary margin.

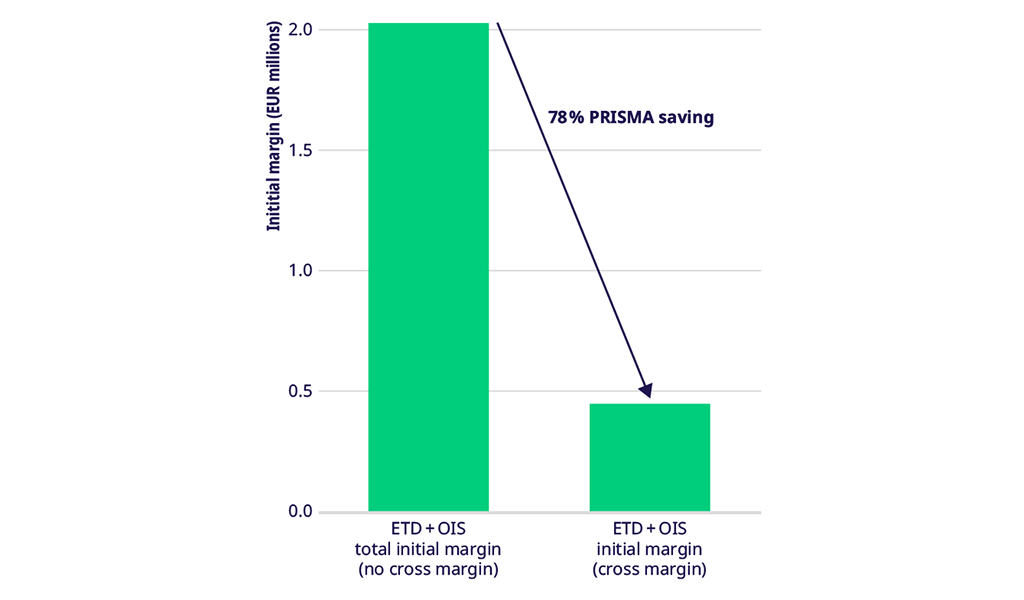

This example illustrates the power of cross-product margining to reduce margin requirements and funding costs when clearing Euro-denominated fixed income short—and long-term— exchange-traded and OTC derivatives at Eurex.

The combined 1Y EUR 100mil notional trade on Eurex, whereby a short €STR Futures is combined with a Fixed Receiver €STR OIS, has around 66% margin reduction compared to trading OTC swaps elsewhere. For a 2Y trade with the same notional and directionality, the margin reduction is 78%. For a long €STR Futures vs. a Fixed Payer €STR OIS, the margin reduction is 78% for a 1Y trade and 77% for a 2Y trade.

For both 1Y and 2Y, the cross-margined amount is lower than the initial margin for either of the two legs separately.

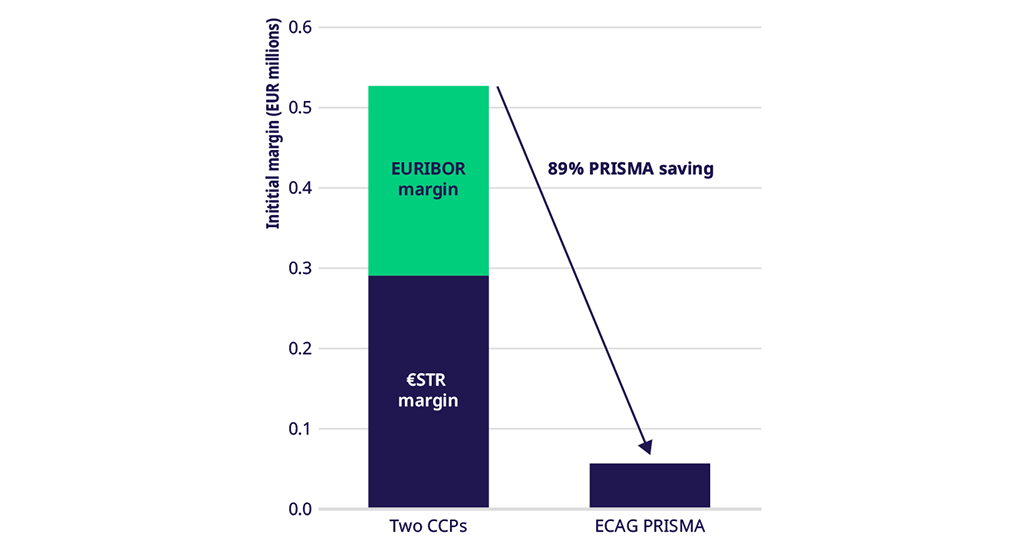

Inter Product Spread Benefits:

Trading €STR strip vs EURIBOR strip at Eurex can see cross-margining benefits of up to 89%.

*In compliance with regulations, margin savings are capped at 80%, the exceedance is charged via supplementary margin.