Volatility Interruption Functionality

Dynamic Volatility Interruptions

The Eurex Volatility Interruption Functionality is a safeguard which aims to ensure market integrity and price continuity by preventing matching of incoming orders that would lead to an erroneous trade price and to stop sudden price cascades.

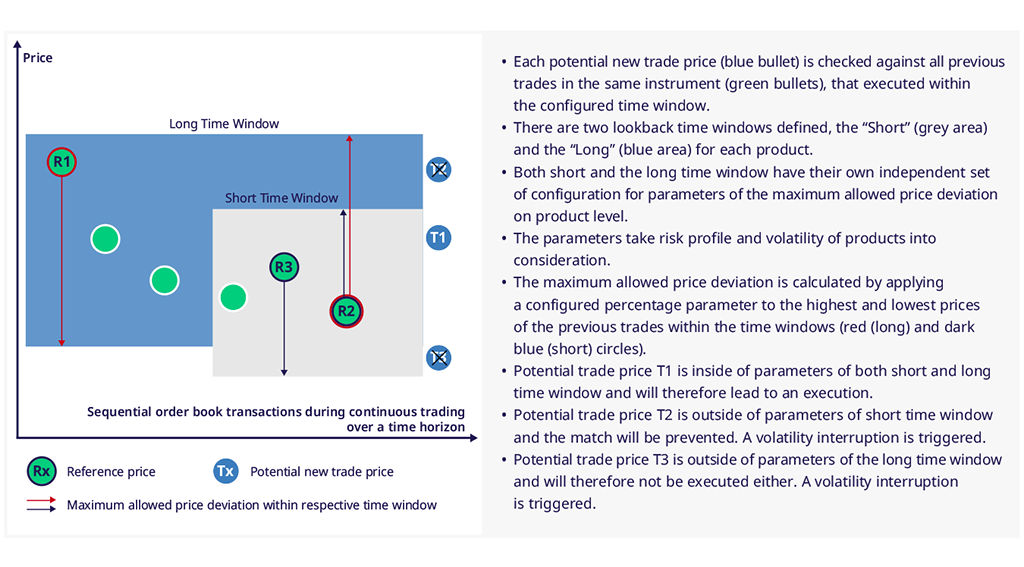

In the functional concept of the dynamic Volatility Interruption, the potential trade price of an incoming order is checked against all prices of previously executed trades in the same instrument within configured lookback windows, the so-called reference prices. In order to account for different liquidity scenarios, Eurex currently applies two time windows, a "short" and a "long" one, configured for each product together with the respective parameters for the allowed price deviation.

A dynamic Volatility Interruption will be triggered if the allowed price deviation is exceeded,, i.e.:

- Potential trade price of an incoming order > Reference Price Low + maximum allowed price deviation or

- Potential trade price of an incoming order < Reference Price High - maximum allowed price deviation

As a consequence of triggering a dynamic Volatility Interruption, the execution of the incoming order will be prevented and the affected instrument or all instruments of the affected product will be automatically moved from continuous trading to a volatility auction. The incoming order that triggered the volatility auction is written to the auction book, or in case of an IOC order, it is cancelled. Executions which happened before the volatility interruption was triggered, remain valid.

Eurex does not disclose price thresholds determining the dynamic Volatility Interruption range. Different price thresholds are applied for the different lookback time windows. Eurex automatically widens the price thresholds for dynamic Volatility Interruptions in case fast market is announced for a product.

Eurex volatility auctions behave like normal Eurex auctions, market participants are able to submit, maintain or cancel orders without matching taking place.

Eurex applies no minimum time interval for dynamic Volatility Interruptions. All Futures products are in scope of automatic monitoring for Dynamic Volatility Interruptions

Static Volatility Interruptions

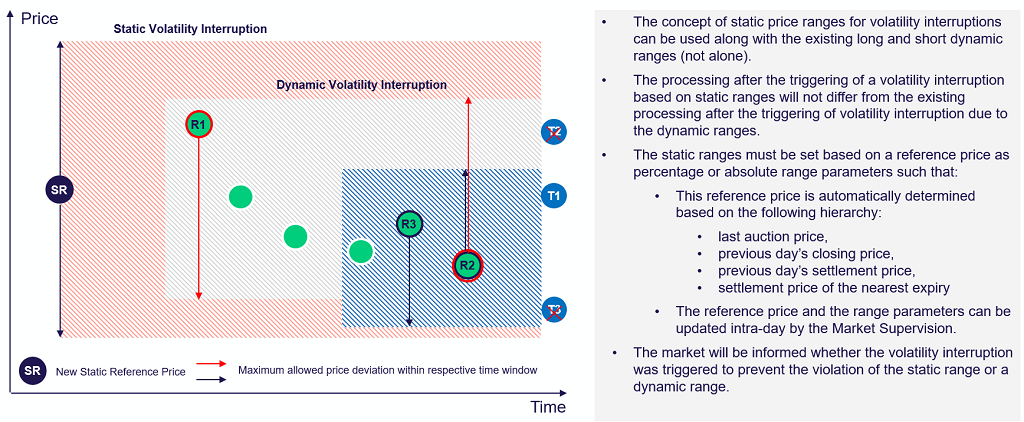

With T7 Release 12.1, an additional trigger mechanism for Volatility Interruptions was introduced, which is based on static price ranges around additional reference prices defined by the exchange. This so-called static Volatility Interruption will be triggered once the allowed static price deviation is exceeded.

A static Volatility Interruption will be triggered if the allowed price deviation is exceeded, i.e.:

- Potential trade price of an incoming order > Static Reference Price + maximum allowed price deviation or

- Potential trade price of an incoming order < Static Reference Price - maximum allowed price deviation

As a consequence of triggering a static Volatility Interruption, the execution of the incoming order will be prevented and the affected instrument or all instruments of the affected product will be automatically moved from continuous trading to a volatility auction. The incoming order that triggered the volatility auction is written to the auction book, or in case of an IOC order, it is cancelled. Executions which happened before the volatility interruption was triggered, remain valid.

Eurex volatility auctions behave like normal Eurex auctions, market participants are able to submit, maintain or cancel orders without matching taking place.

Reference prices for determining a static Volatility Interruption remain static over the trading day and will automatically update based on the following hierarchy:

- Last auction price (this includes volatility auction prices),

- Previous day’s closing price,

- Previous day’s settlement price,

- Settlement price of the nearest expiry

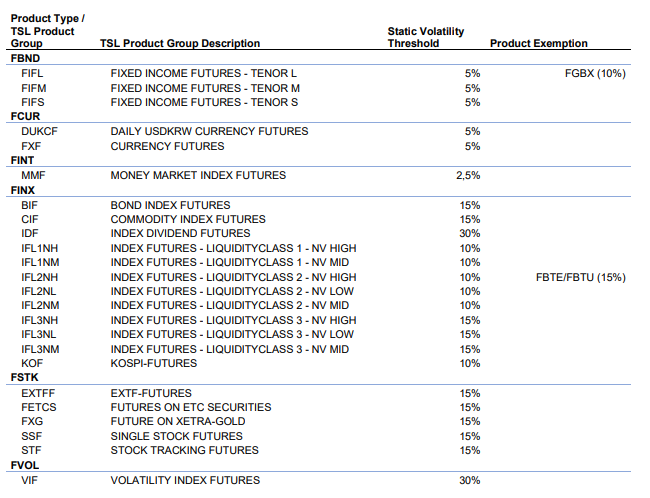

Price thresholds determining the static Volatility Interruption range around the respective reference price will be set for each Futures product grouped per TSL product group which are also applied for Transaction Size Limits at Eurex:

As an example: The EURO STOXX 50® Index Futures (FESX) based on an opening index level of 5.075,00 would be allowed to trade up to 5,582,00 over the trading day before the static Volatility Interruption will trigger an auction where Trading Participants may contribute to determine an auction price which will become the new reference price for the subsequent continuous trading phase.

Static Volatility Interruptions are activated as of 8 July 2024.

Eurex will not widen the price thresholds for static Volatility Interruptions in case fast market is announced for a product. However, Eurex Market Supervision may update static reference prices intra-day if needed.

Eurex applies no minimum time interval for static Volatility Interruptions. All Futures products are in scope of automatic monitoring for Static Volatility Interruptions excluding products with different trading clearing notation (e.g. Total Return Futures, Variance Futures, Market-on-Close Futures) due to different trading notation compared to reference price.

For further information please refer to Chapter 7.5 Volatility Interruption in the Functional Reference.

Eurex EnLight / Eurex T7 Entry Services

Eurex EnLight is an on-exchange, off-book selective Request-for-Quote (RFQ) functionality, where circuit breakers are implemented in the form of price collars. These price collars reject quotes or orders if the contract price falls outside an entry interval defined by the Management Board. Importantly, price collars do not trigger a trading halt.

The same price collar mechanism applies to Eurex T7 Entry Services, which allow Trading Participants to enter order information for off-book transactions into the Eurex system.

The contract prices of responder quotes and requester limits in Eurex EnLight, and entries submitted for Eurex T7 Entry Services are validated against boundaries and reference prices as defined in the Contract Specifications for Futures and Options Contracts at Eurex Deutschland, specifically in Subpart 3.1 – Entry Intervals for Contract Prices.