Connectivity Support

Overview of content

Connecting to the Exchange

As an Exchange Participant, you have a range of alternatives to connect to our markets. Eurex Exchange interfaces offer hardware independence, high levels of customization and flexibility. Our portfolio of connectivity alternatives is designed to meet the needs of a variety of users, from low-latency Market Makers to institutional buy-side customers. With this broad offering, you can select which connectivity solution best suits your individual needs. Whether you seek a high-frequency interface or one that utilizes the industry-standard FIX, we offer what you need. Healthy markets are made up of a wide range of Participants that employ vastly different trading and investment strategies. Because a one-size-fits-all approach would be ill-suited for our Participant base, we designed a customized approach to ensure that you can choose the connectivity alternatives based on your unique business needs.

What connectivity pieces you need to participate

Your company will need to select one option from each of the columns below. We briefly explain why you need one of each component. In the overview below, we provide a definition of each connectivity alternative.

The list below is meant as an introduction. Our sales staff as well as technology contacts will guide you to ensure that you select the appropriate setup. They will also provide detailed information on technical and functional specifications as well as walk you through pricing.

| Trading | Data | Drop Copy | Eurex Trader GUI Access | Eurex Admin GUI Access | |

| What is it? | Two-way trading interface | One-way receipt of market data | Cross-check your position | Complete trading functionality, risk controls including emergency stop and mass delete | Setup of new traders, trader limits, risk controls including emergency stop and mass delete |

| Eurex ETI (high throughput and low latency) | Eurex EMDI (high throughput and low latency) | Eurex FIX LF Interface (low-throughput) | Two connectivity options available, access via web or leased lines | ||

Eurex FIX LF Interface (low-throughput) | Eurex EOBI (high throughput and low latency, un-netted with enhancements) | Eurex Clearing FIXML Interface (high throughput and low latency) | Two connectivity options available, access via web or leased lines | ||

| Eurex MDI (netted) | Eurex ETI Back Office session | ||||

| Eurex RDI (reference data) |

Which interface is right for you?

| Interface name | High or low frequency? | What does it do? |

Eurex Enhanced Trading Interface (Eurex ETI) | High | The Eurex ETI is the high-performance, low-latency trading interface designed for Participants that require optimal performance and customization. This interface supports full trading functionality, including Market-Making. |

Eurex FIX LF Interface | Low | The Eurex FIX LF Interface is designed for Participants who want to utilize the industry standard FIX Protocol. |

Eurex Enhanced Market Data Interface (Eurex EMDI) | High | This interface provides un-netted price level aggregated market data using multicast technology. It also provides un-netted market data. The updates of the order book are delivered for all order book changes up to a given level; all on-exchange trades are reported individually. |

| Eurex Enhanced Order Book Interface (Eurex EOBI) | High | Though most of the functional concepts are similar to the Eurex EMDI, the EOBI provides several enhancements including but not limited to: side, price, priority timestamp and displayed quantity of each visible order and quote, trade price and traded quantity for each executed on-exchange trade, order book information disseminated without any depth limitation and manually entered trades and trade reversals by Eurex Market Supervision. This interface provides the entire visible order book, by publishing information on each individual order and quote along with state information in un-netted manner. All on-exchange trades are reported individually. See “T7 Enhanced Order Book Interface - Manual ”. |

| Eurex Market Data Interface (Eurex MDI) | Low | This interface provides netted price level aggregated market data using multicast technology. |

| Eurex Reference Data Interface (Eurex RDI) | N/A | This interface provides reference data via high bandwidth connections, including intraday updates. Some reference data (e.g.) for strategies created intraday is also disseminated via Eurex MDI and the incremental channel of Eurex EMDI. It provides reference data for products and instruments that are available for trading on the T7 Exchange’s T7. The reference data is delivered on a product and instrument level. Every tradable object is referenced by a unique identifier, for this reason the reference data information is absolutely essential for any trading application. |

Eurex Extended Market Data Service | Low | The interface provides public off-book trade prices, intraday settlement prices and adjusted open interest. It also allows Participants to replay market information. |

Eurex Trader GUI | N/A | The "Eurex Trader GUI" provides access to trading functions for orders and Eurex Trade Entry Services. Authorized traders can also trigger an emergency stop trading and other risk controls on this GUI. It is recommended that Participants also operate the Eurex Trader GUI as a backup to alternative front-end systems. |

Eurex Admin GUI | N/A | The "Eurex Admin GUI" allows authorized users to perform administration functions, e.g. set up new traders, administer user access rights and assign product limits. Authorized administrators can also trigger an emergency stop and other risk controls on this GUI. |

| Common Report Engine (CRE) | N/A | Trading reports and files, audit trail reports and reference data files are provided exclusively via this service. |

FAQ

- You can create new requests in the Member Section.

- Follow next steps based on your desired service which you want to order under the following path:

Technical Connection > Request & Configuration > New Request > New Connection

An overview of the connectivity options can be found here.

Information can be found on the following website.

Information about the Simulation calendar can be found here.

- Trading session: supports order management, request for quote, cross trade announcement, Client Liquidity Improvement Process (CLIP) (Derivatives only), risk control events, strategy creation (Derivatives only) and off-book trade entry (Cash only). Each session will receive information for all of its own orders. Several traders may share a single session, but every session can only be instantiated once.

- Back-office session: used for receipt of trade confirmations at business unit level. Clearing business units receive trade confirmations from their trading business units and from their non-clearing members. Back-office sessions can be configured to receive additionally drop copy information for standard (not lean) orders as well as risk control events at the business unit level. The clearing members don’t receive drop copy order information from their non-clearing members

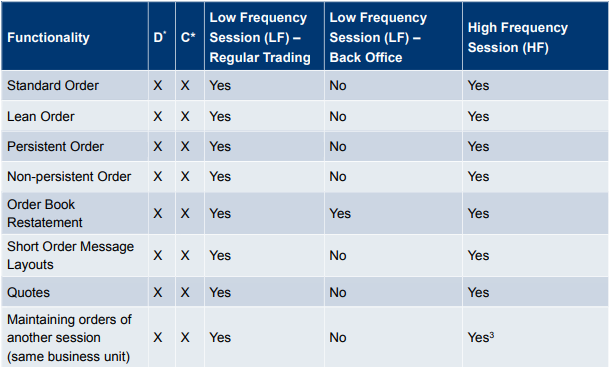

The ETI interface will supports three session types: low frequency sessions for regular trading, low frequency session for back office, and high frequency session. The following table provides an overview on the functionality supported by the different session types:

Full description of the order types supported via the T7 FIX LF Interface can be found in the section 3.8.1 of the T7 FIX LF Interface manual.

Tutorial Videos

Contact us

Eurex Frankfurt AG

Key Account Management

Service times: Monday to Friday 09:00 - 18:00 CET