Excessive System Usage Fee

Eurex has introduced the Excessive System Usage Fee on 1 December 2013. In order to encourage a responsible attitude towards the use of the T7 system resources, Eurex defines daily limits for the number of transactions sent by a Participant. If a Participant exceeds the defined limits then fees for excessive system usage may apply.

The transaction limit is calculated per Participant, per product, per trading day and per limit type. There are three types of transaction limits: a transaction limit for the order type "standard orders", a transaction limit for "all transactions", and a transaction limit for "transactions which do not lead to an market data update and order modifications which lead to an order cancelation without a trade". Every day, for each Participant, the actual transactions are counted per product. If this transaction count exceeds the transaction limit, then such instance is considered to be a violation of the limit.

There are two different types of violations:

- Accidental violation: A violation of the limit is considered to be "accidental", if a limit is exceeded less than four times for a product in a calendar month. An accidental violation is not subject to the ESU Fee.

- Systematic violation: A violation of the limit is considered to be "systematic", if a limit is exceeded more than three times for a product in a calendar month. All systematic violations are subject to the ESU Fee. The ESU Fee is applied to all violations in that particular month.

Violations are counted per product across three limit types.

The ESU Fee is calculated using the following equation:

ESU Fee = [ (number of transactions) - (transaction limit) ] * fee

A transaction is defined as a system message that reaches the matching engine and yields a response. Such a transaction can be identified by inspecting the system response. If the response contains a time stamp from the matching engine the message is added to the daily transaction count of the Participant for the respective product.

The transaction limit is comprised of two components:

- A volume component, which is calculated by multiplying the volume in the order book by a predefined volume factor, and

- a floor, which is set for each Participant regardless of any traded volume in the order book. A Market Maker can receive a higher floor, depending on its Market-Making performance.

Please find below a concept paper describing the calculation (including an example) in detail.

The table below shows the parameters used to calculate the ESU Fee.

Please note: The limit is defined based on the product type of the product.

A Trading Participant, acting as liquidity provider and fulfilling the defined requirements of the so-called Stress Presence Building Block of the General Supplement of the Eurex Liquidity Provider Agreement on a day with Stressed Market Conditions, is eligible for an increased MM base by 10% on that day.

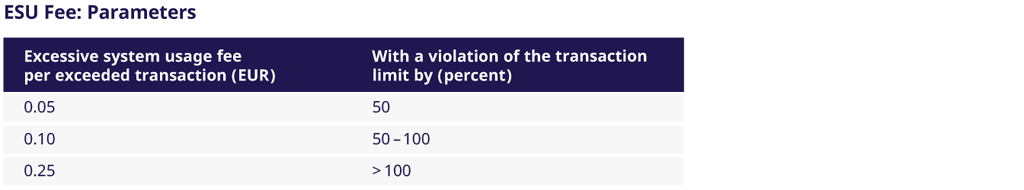

The following table shows the fee parameters that will be used to calculate the ESU Fee. It is important to note that the sliding scale of the range mentioned in the table is applied to the transactions which are in excess of the transaction limit. The percentage values in the range are relative to the individual transaction limit.

The following reports will be available for the Participants on the Common Report Engine:

- CB069 (Transaction Report): Report is generated on a daily basis. Additionally, intraday versions of the report are available every thirty minutes

- TR102 (Excessive System Usage Report): Report is generated on a daily basis

- TD954 Stressed Market Conditions): Report is generated on a daily basis

- TR104 (Eurex Daily ESU Parameter): Report is generated on a daily basis

- TR105 (Minimum Quotation Requirement): Report is generated on a daily basis

- TR107 (Excessive System Usage Detailed Transaction Report): Report is generated on a daily basis

- CB197 (Excess Transaction Limit Fees): Report is generated at the month-end