Eurex Improve

Full execution at best available price

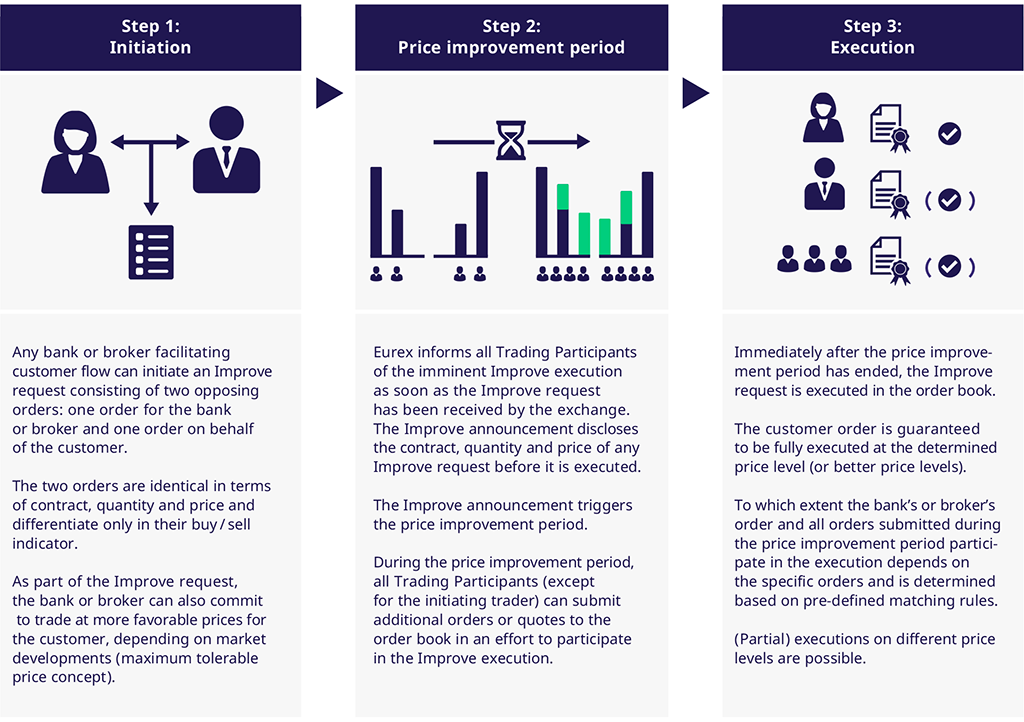

Eurex Improve provides Trading Participants with a tool suited to guarantee their customers complete execution of orders below minimum block trade sizes at the best available price. Execution at this best available price is ensured as Eurex Improve is fully integrated into Eurex’s order book and benefits from the order book’s pricing competition. It is available for all equity and equity index options. Eurex Improve automatically fulfills the best execution standards defined by MiFID II.

With Eurex Improve, Eurex allows flow providers (banks or brokers) to continue offering liquidity to their non-Eurex customers, under certain price conditions. First, the trade is agreed between customer and flow provider and, afterwards, offered for execution into the public order book to check the availability of better prices (from the customer point of view) posted by other market participants. The Eurex Improve mechanism is fully compliant with the transparency regime of MiFID II.

The functionality therefore offers significant advantages to all parties involved:

- Flow providers, who can now benefit from an additional tool to execute transactions requested by its clients, with a size below minimum block trade size

- Customers, who have the possibility to achieve a price improvement

- Whole market and, particularly, to liquidity providers, by encouraging a tightening of the spreads available in the public order book

Buyside electronification and Eurex Improve – a perfect fit!

Industry viewpoint by Andre Eue and Markus-Alexander Flesch in Best Execution magazine

Benefits

Eurex Improve adds value to the overall market structure, by providing advantages to all involved stakeholders -

Learn how it works:

- The customer is guaranteed full execution of their order at a determined price level or better price levels.

- Banks and brokers are provided with a tool to generate additional customer flow, as they can ensure full execution of their customers' orders below minimum block trade sizes.

- Liquidity providers have the opportunity to engage with order-flow which otherwise might have been executed without their participation. Once an Improve request has been announced, execution of the customer order is guaranteed.

Functioning

FAQs

- When using Eurex Improve as a customer, you benefit from guaranteed execution of your trade sizes below minimum block trade size at the best price available in the order book.

- To benefit from Eurex Improve as a customer, your bank or broker (a Eurex exchange participant) needs to agree to offer this service to you.

- When using Eurex Improve, your bank or broker commits to trade against you at a pre-determined price. In addition, your bank or broker commits to subject your order to the full price competition of the order book, ensuring you are executed at the best available price.

- If you would like to use Eurex Improve as a customer, please contact your bank or broker to see whether they can offer you this service.

- If you are a bank or broker, Eurex Improve provides you with an additional tool to ensure best execution of your customers' orders and hence generate additional trading volumes.

- To be entitled to initiate an Improve request, you need to a) have received a customer order, and b) be willing to trade against your customer for this order.

- You can initiate an Improve request using a dedicated order type ("CLIP order type") either via the Eurex T7 GUI or via ETI.

- As a liquidity provider, you benefit from the possibility of participating in additional trading volumes generated via Eurex Improve.

- The announcement of an imminent Improve execution is distributed via the regular market data feed. Once an announcement has been made, it is guaranteed that a respective customer order is executed in the order book after 150 milliseconds.

- If you want to react to an Improve announcement, you do not need to mark your order(s) in any way. In fact, even if you did not react to an Improve announcement but send an order during the price improvement period, it will be considered part of the Improve execution following the predefined matching rules.

- During the 150 milliseconds long price improvement period between the Improve announcement and the Improve execution, "regular" order book trading continues. During this time, you can send, amend and cancel as many orders as you wish, for any quantities and prices you would like.

- Any orders resting in the order book before an Improve request is initiated, maintain their priority.

Tutorial

Tutorial: initiate an Improve request via the Eurex T7 GUI

No content displayed? By accepting our cookies you enable video features, improve your site experience and support our marketing efforts.

Contact

Markus-Alexander Flesch

Market Development & Pricing

T +41-43-430-71 21