Special and GC Repo

Established in July 2001, the Special and GC Repo segment offered by Eurex Repo GmbH has developed tremendously and is now a highly liquid market for European securities. As of September 2024 more than 160 international participants benefit from anonymous trading and clearing through a central counterparty with low costs.

In the General Collateral (GC) Repo segment, collateral can be turned into cash swiftly and directly, while the Special Repo segment offers a market for single securities financing.

Principles

Special and GC Repo participants can trade repos with a wide range of around 7,500 fixed income securities divided into 41 different baskets. In both segments, the General Collateral (GC) and the Special Repo segment, collateral can be turned into euro or pound sterling swiftly and anonymously with low risk through a central counterparty.

In the GC Repo segment, the manual allocation of single securities after the conclusion of a basket trade enables a selective collateralization directly via the trading screen.

The market offers securities such as:

- European Government Bonds

- Jumbo-Pfandbriefe and Pfandbriefe

- KfW/Laender Bonds

- European Covered Bonds

- Agency Bonds

- European Corporate Bonds

All securities of the various baskets can be traded in the Special segment as well.

Eurex Repo

Eurex Repo Sales & Relationship Management

Frankfurt/London/Paris/Zug

Specifications

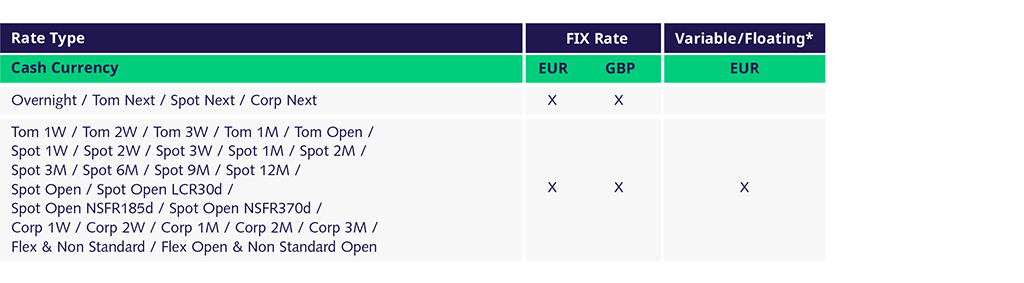

Multiple standard terms from overnight up to more than two years are offered.

In addition open, variable and open variable terms offer maximum flexibility.

* Variable/Floating Rates:

€STR = Euro Short-Term Rate

GCPION = STOXX GC Pooling EUR ON Index

Open Order Book

The quote book contains all quotes entered by the participants with full market depth. The quotes are displayed per term/collateral combination including volume. All quotes are legally binding and will be automatically deleted at market close. Eurex Repo does not offer an automatic matching. The traders have to lift or hit a quote proactively. In addition to entering quotes two participants may agree on a trade bilaterally and enter the repo transaction into the system by using the pre-arranged trading functionality.

Contract Size

Minimum EUR, GBP 1 Million for GC Repo

Minimum EUR, GBP 500,000 for Special Repo

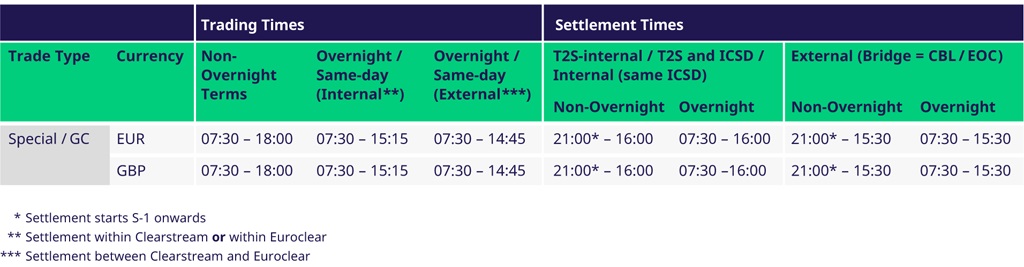

Trading Hours

Pre-trading phase: 07:00 - 07:30 Frankfurt am Main time

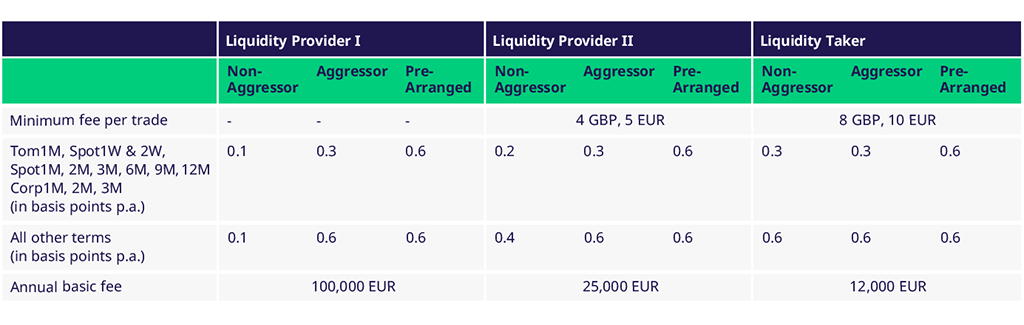

Trading Fees

- Registration fee of EUR 5,000

- Minimum transaction fees of EUR 800/month

- Annual and transaction fees according to the below listed fee group

Value Chain

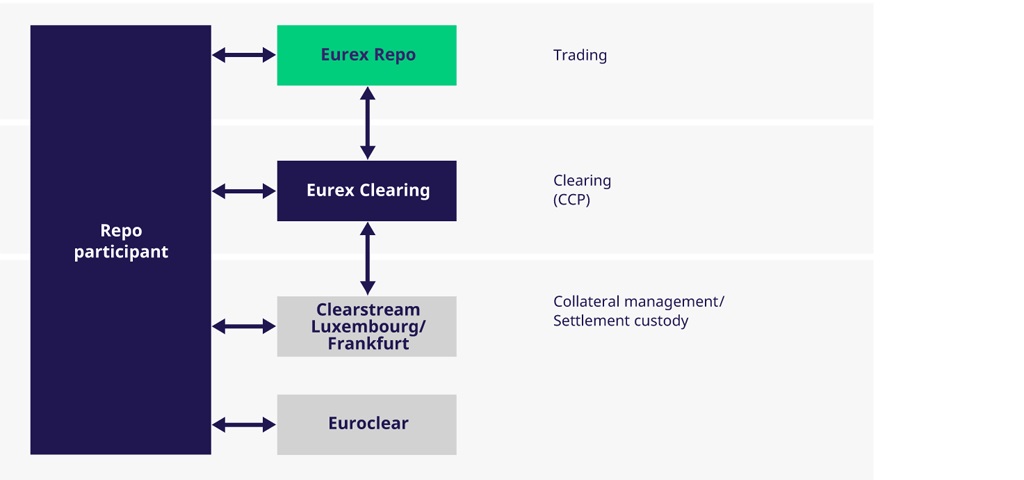

The Special and GC Repo segment ensures straight-through processing with automated connectivity to Eurex Clearing AG as central counterparty and the settlement organizations Clearstream Banking and Euroclear.

As soon as a repo transaction is concluded on the electronic Eurex Repo trading system, Eurex Clearing steps in as legal counterparty (CCP). Due to the anonymous trading through the CCP the participants do not have any legal relationship and bilateral risk with another bank.

Eurex Clearing performs e.g. the delivery management and the intra-day risk evaluation of all positions held by a participant. A comprehensive reporting informs the participant about the status of delivery activities and the margin requirements. On the settlement day Eurex Clearing sends the settlement instructions on behalf of the participants to Clearstream or Euroclear. Both settlement organizations provide reports on the settled cash and collateral.

Clearing Services

Eurex Clearing AG provides a complete set of clearing and risk management services for leading exchanges and marketplaces.

Participation

- The applicant must be under the regulation of a domestic regulatory Authority

- The applicant must be a credit institution or an investment firm according to the definition set forth in Art. 1Paragraph 1 and 2 and Art 4 Paragraph 1 of the Council Directive on markets for financial instruments 2004/39/EG ("MiFID")

- The applicant is responsible for the technical connection to the Eurex Repo trading system

- The applicant is required to follow the Eurex Clearing clearing process

- Directly: As a Clearing Member of Eurex Clearing

- Indirectly: By signing an agreement with an existing Clearing Member

The applicant may apply for a General-Clearing or Direct-Clearing-Membership. The General Clearing Member (GCM) has the right to clear its own trades as well as the trades of its customers and DC Market Participants. The Direct Clearing Member (DCM) has the right to clear its own trades as well as the trades of its customers and NCMs provided they are affiliated.

Institutions and/or its branches which are permitted in its country of domicile to provide credit to customers in relation to the matching of orders or quotes and receive collateral from customers in the form of securities and cash may apply for admission.

In addition the Clearing Member must fulfill the following requirements:

- Minimum amount of liable equity capital

- Default fund contribution

- Cash Clearing: RTGS eligible account

- Pledge Securities Account

Once a company becomes a participant, Eurex Repo does not limit the number of registered persons on its behalf.

Participant List

Citadel Securities GCS (Ireland) Limited has joined the Repo market as of 29 December 2023

Eurex Repo

Eurex Repo Sales & Relationship Management

Frankfurt/London/Paris/Zug

Margining

Eurex Clearing Margin Parameters, Margin Groups and Margin Class

The Eurex Clearing Margin Parameter, Margin Group association and Margin Class for each individual security is available on Eurex Clearing`s webpage. Please open the file "Margin Parameters for Bonds and Repos" which is updated on a daily basis.

Cloud Prisma Margin Estimator for Fixed Income Repo (Repo Cloud PME), individual and portfolios of single ISIN repos, by Eurex Clearing:

The service builds on the Cloud PME for ETD and OTC IRS, is free of charge and specifically tailored for end users who wish to estimate margin requirements for individual or whole portfolios of single ISIN repos. Repo Cloud PME is easy to use and is accessible via any web browser. Alternatively, a standard API connectivity is available.

In addition, Eurex Repo F7 users will be able to export their repo portfolio for simplified upload to the Repo Cloud PME from 29 Nov 2021.

Benefits

- Transparency: Provides detailed information on Eurex Clearing repo margin requirements based on Eurex Clearing’s RBM margin methodology

- Portfolio margining: Allows users to readily estimate margin requirements even for large portfolios in order to identify potential margin offsets

- Accessibility: Enables margin simulation in a user-friendly environment and hassle-free integration with client systems and processes through web based GUI or REST API

- Functionality: Portfolio up- & download, bond price shifts, simulation of future settlements, historic margin estimations

- Costs: The Repo Cloud PME is free of charge

Please note, open repos, floating rate repos and GC Pooling transactions are currently out of scope. Release of new features based on client demand.

Description of the Repo Cloud PME and webpage:

Repo Cloud Prisma Margin Estimator (Repo Cloud PME)

Video Tutorial - Repo Cloud Prisma Margin Estimator (Repo Cloud PME)