14 May 2024

Eurex

Eurex Repo Monthly News April 2024

Market briefing: ''Strong momentum in April 2024''

by Frank Gast - Managing Director, Member of the Management Board, Eurex Repo

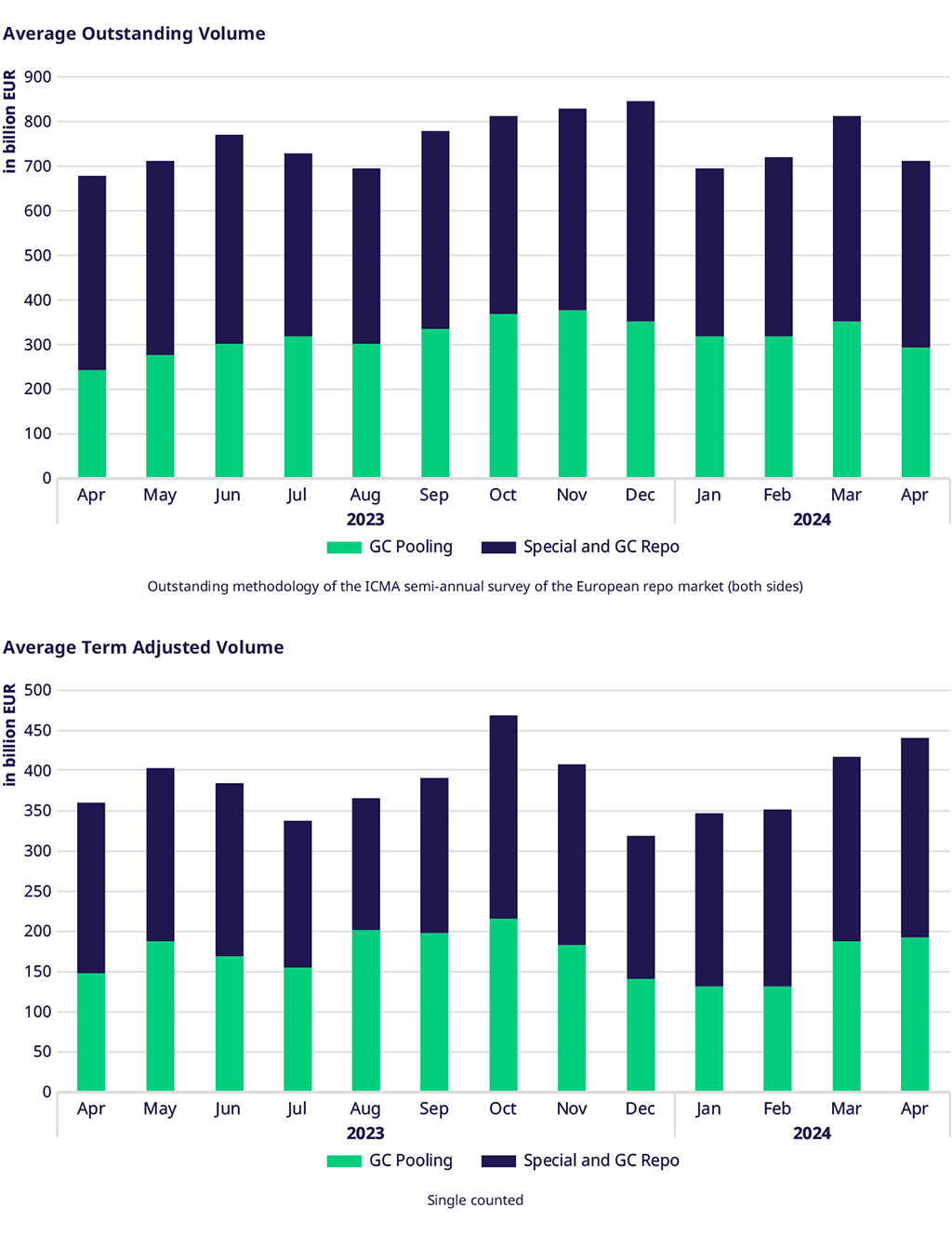

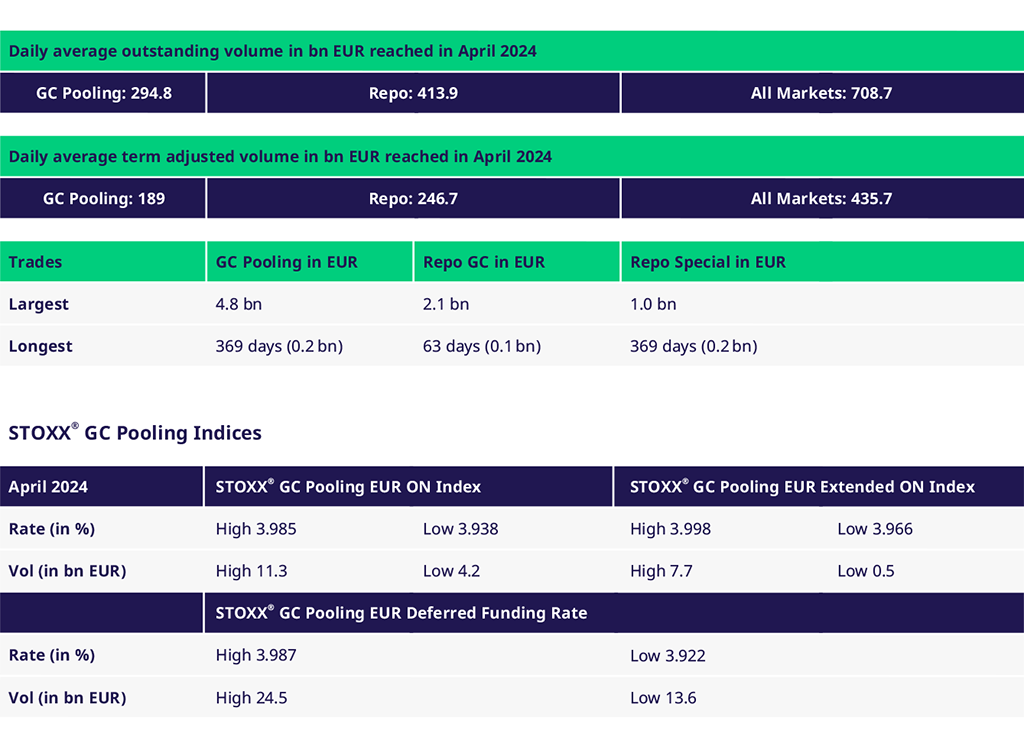

Eurex Repo maintained strong momentum in April 2024, with average term-adjusted volume surging to an impressive €435.7 billion. This represents a significant 20% increase month-over-month and a robust 24.4% rise year-over-year. The growth was fueled by both segments: GC Pooling jumped 26.8% to €189 billion, while the Repo segment climbed 15.6% to €246.7 billion.

Outstanding and Traded Volumes

Additionally, Eurex Repo experienced a surge in activity year-over-year, with average trading volume climbing 16% and average outstanding volume rising 18.1%. This growth reflects sustained demand for liquidity, particularly evident in the GC Pooling segment, which saw a remarkable 27% increase in average trading volume and a significant 47.8% rise in average outstanding volume.

Spreads and Collateral

EURO repo rates edged slightly lower in April, reflecting increased liquidity in the market and a wait-and-see approach before key economic data and central bank meetings.

By month-end, GC Pooling ECB basket traded in overnight at 3.938% (-6.2 bps vs DFR) and the EXT basket at 3.966% (-3.4 bps vs DFR). The average spread between these two baskets further tightened to 1.39 basis points.

Eurex Term Repo

GC Pooling remained active, particularly in the ECB classic basket (standard terms, 2 weeks - 12 months) with tight spreads visible in the order book, particularly in the three to six month term bucket.

Single ISIN trading also saw noteworthy activity, with EUR 500 million in French government bonds (3-month floating rate vs ESTR). Additionally, July 1st term date Specials trades were particularly active, especially for French government bonds (fixed and floating).

Government Bonds

While overall repo specials activity dipped only 5% year-over-year, trading in German government bonds ("Bund") specials saw a steeper decline of 30%. This suggests a shift in focus towards other eurozone government bonds, particularly those from France, Spain, and Italy. However, compared to March, Bunds trading volume actually increased by 13%. Additionally, active quotes in order books for Belgian, Austrian, and Finnish bonds also contributed to higher overall trading.

EU Bonds and SSAs

Supranational and agency issuer (SSA) trading volumes climbed 3% compared to March, fueled primarily by increased activity in KfW bonds. Conversely, trading in EU bonds experienced a 20% decline from March levels. However, allocations within the GC Pooling segment for EU bonds remain robust, hovering between EUR 10 billion and EUR 12 billion.

Events - save the date

Eurex Repo update roundtables:

📍 Paris, 15 May

📍 Brussels, 21 May

Eurex Repo sponsoring:

📍 ICMA AGM & Conference, Brussels, 22-24 May

📍 ISLA 31st Annual Securities Finance & Collateral Management Conference, Geneva, 18-20 June

NEW GC Pooling Green Bond Basket

Finally, based on client consultations, a new GC Pooling basket focusing on green assets was launched on April 29th, and the first successful trades have already been executed. Please check here for further information.

Volumes

Participants

View the current Participant List Repo and GC Pooling.

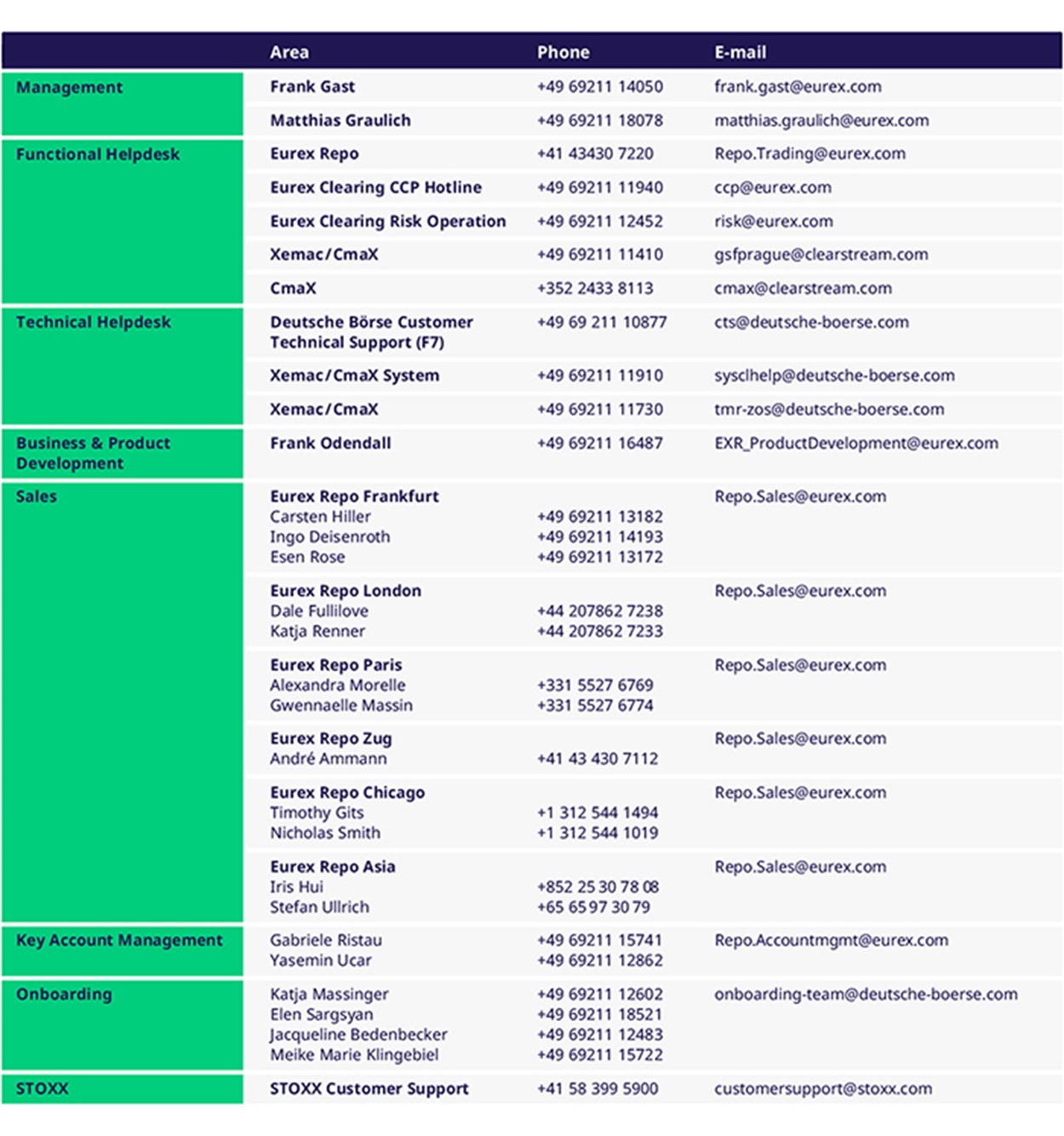

Services & Contacts