26 Feb 2024

Eurex

Eurex Repo Monthly News January 2024

Market briefing: ''January 2024 continued with strong momentum''

by Frank Gast - Managing Director, Member of the Management Board, Eurex Repo

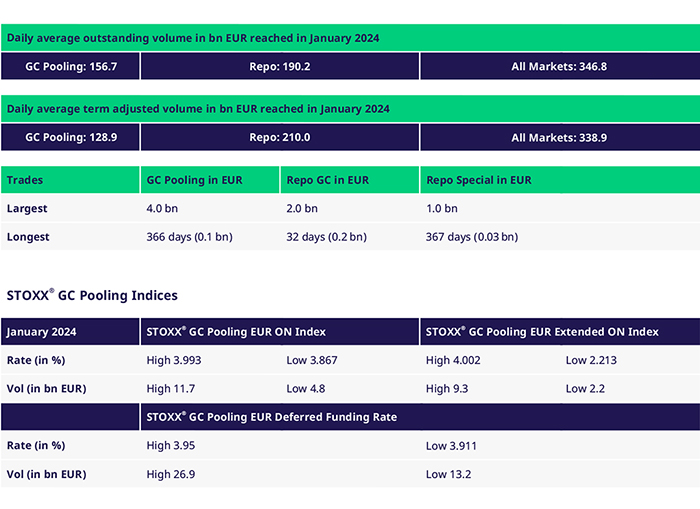

After a successful year came to an end, January 2024 continued with strong momentum. The average term adjusted volume in January 2024 increased to €338.9 bn.

Thereof the GC Pooling market increased to €128.9 bn and Repo Market to €210 bn.

Outstanding & Traded Volumes

Comparing January 2024 with January 2023, the average outstanding volume on all market segments combined increased by 25%. This was mainly driven by the GC Pooling Market with an increase of 51.1% with our Specials / GC segment showing an increase of 9.4%.

Eurex Repo’s average traded volume January 2024 compared to January 2023 increased slightly by 1.5%.

Spreads and Collateral

Short-term rates in GC Pooling have normalized to pre-year-end levels, with spreads between the ECB and EXT ECB baskets in overnight tightening to 2-0 bps. Increasing interest has been seen particularly in the ECB Basket for one week and two weeks terms.

Eurex – Home of the Term Repo

While there was an overall decline in the volume of longer-term GC Pooling compared to November and December, there was continued activity in one-, three- and twelve-month maturities, which were mainly traded in the ECB basket.The ECB left policy rates unchanged and forward market expectations continue to predict cuts around mid-year. Eurex Repo saw a definite curve in EUR GC Pooling evidencing expectations of a rate cut beyond the three month term horizon.

Open Repo terms in financials securities remained very popular particularly when used in variable rate context, trading seen with a repo rate spread to €STR. Variable rate repo continued with high trading activity in French Government Bonds and as well in Euro Government Bonds versus €STR in three and six months terms.

EU Bonds and SSAs

While the traded volume in SSAs decreased by 25% compared to January 2023, EU bonds had a fairly good start to the year compared to January of previous years (+27% vs January 2023).

Government Bonds

EUR government bonds were increasingly traded in the repo market until 13 March. In addition, German and French government bonds were traded to a considerable extent until 20 March. Spanish government bonds were mainly traded in the GC segment between one- and three-week maturities.

Report

2023 was a year of transformation in the world of finance. All the trends that have shaped our industry in recent years – including the technological revolution, the sustainability agenda, and geopolitical tensions – have intensified in ways that require even greater engagement, smarter strategies, and greater agility. New risks to financial stability have also prompted regulators to reassess their existing policies. The repo market has also had its ups and downs in this remarkable year. Download the report as we discuss the challenges and successes and look at the issues which are most likely to be relevant in 2024.

GFF Podcast episode 7: GFF Summit live

2024 outlook with industry leaders - What lies ahead?

In this show we interview senior leaders live at the GFF Summit on the rising repo markets, T+1, collateral management, intraday trading, liquidity concerns, AI in finance and much more.

Industry events

GFF Summit 2024 – Review

End of January, Deutsche Börse once again hosted the joint Eurex & Clearstream GFF Summit 2024 in Luxembourg.

This year, we welcomed a record number of 825 participants to the European Convention Centre, where we had exceptional panels on stage and inspiring discussions thereafter.

The summit featured 16 sessions, ranging from the Central Bank Forum's closed-door panels on Tuesday, through the Repo, Lending, and Treasury sessions on Wednesday, right up to the Intra-day liquidity and Tech plenaries on Thursday morning.

Particularly knowledgeable and inspiring was the excellent and well-founded keynote with detailed analyses of the repo market by Thomas Vlassopoulos from the European Central Bank, and the repo market panel titled "European repo markets – scarcity gone for good?"

Moderated by Christoph Rieger from Commerzbank, it covered topics such as the ECB's footprint and supply, leverage & spreads, mandatory clearing, and the potential impact of T+1 settlement.

This international event once again demonstrated that the GFF Summit is much more than a conference; it’s an open forum for exchanging ideas among peers in the secured funding and securities financing industry, connecting with our clients, and networking while taking a glimpse at what the future holds.

If you are interested in some follow-up discussions, please reach out to our Sales & Relationship Management team.

Volumes

Participants

View the current Participant List Repo and GC Pooling.

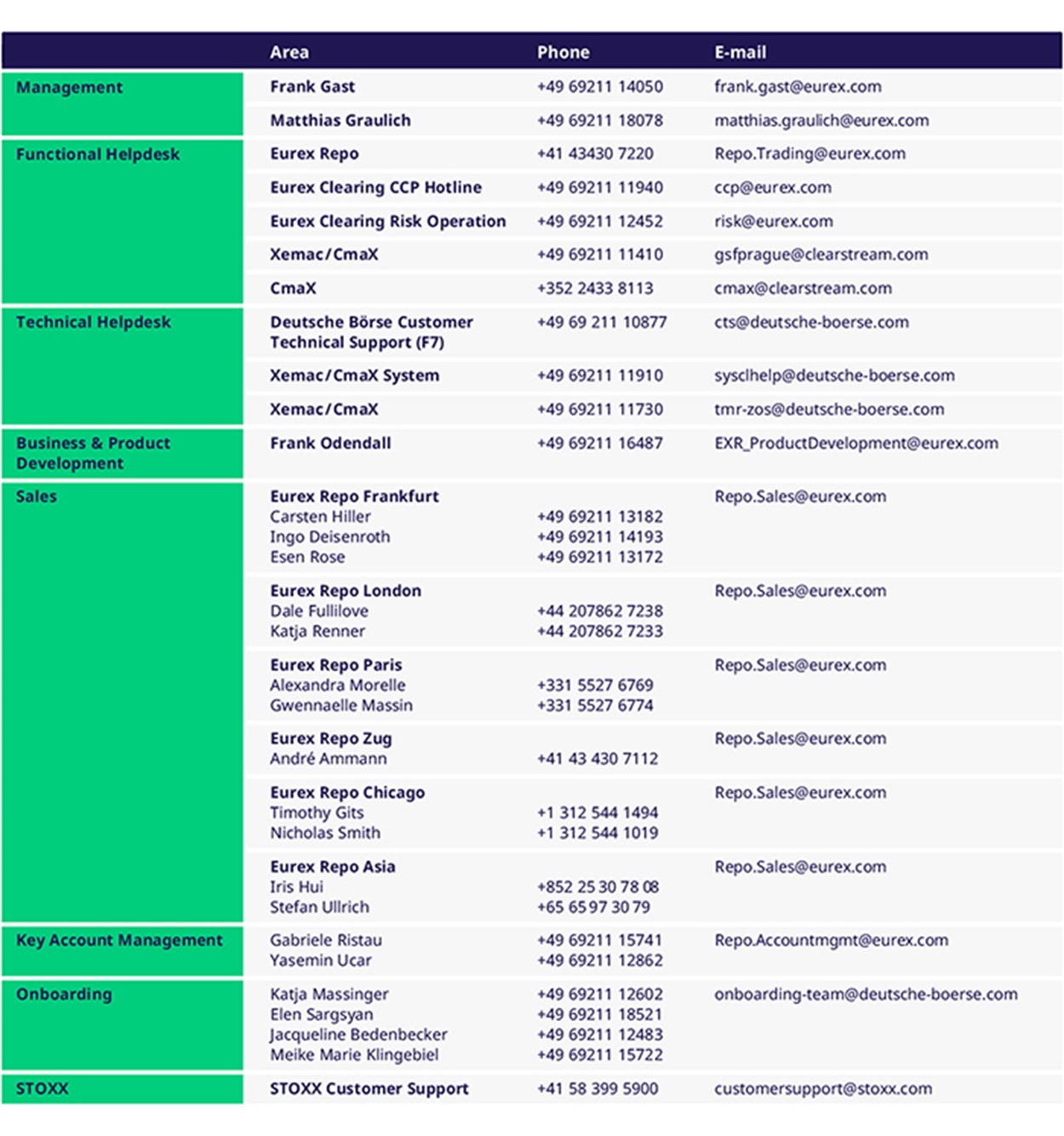

Contacts

For more information, please visit the websites of Eurex Repo and GC-pooling or contact: