12 Aug 2024

Eurex

Eurex Repo Monthly News July 2024

Market briefing: ''Robust rise in term-adjusted volume of 16% in July mainly driven by Special Repo''

by Frank Gast - Managing Director, Member of the Management Board, Eurex Repo

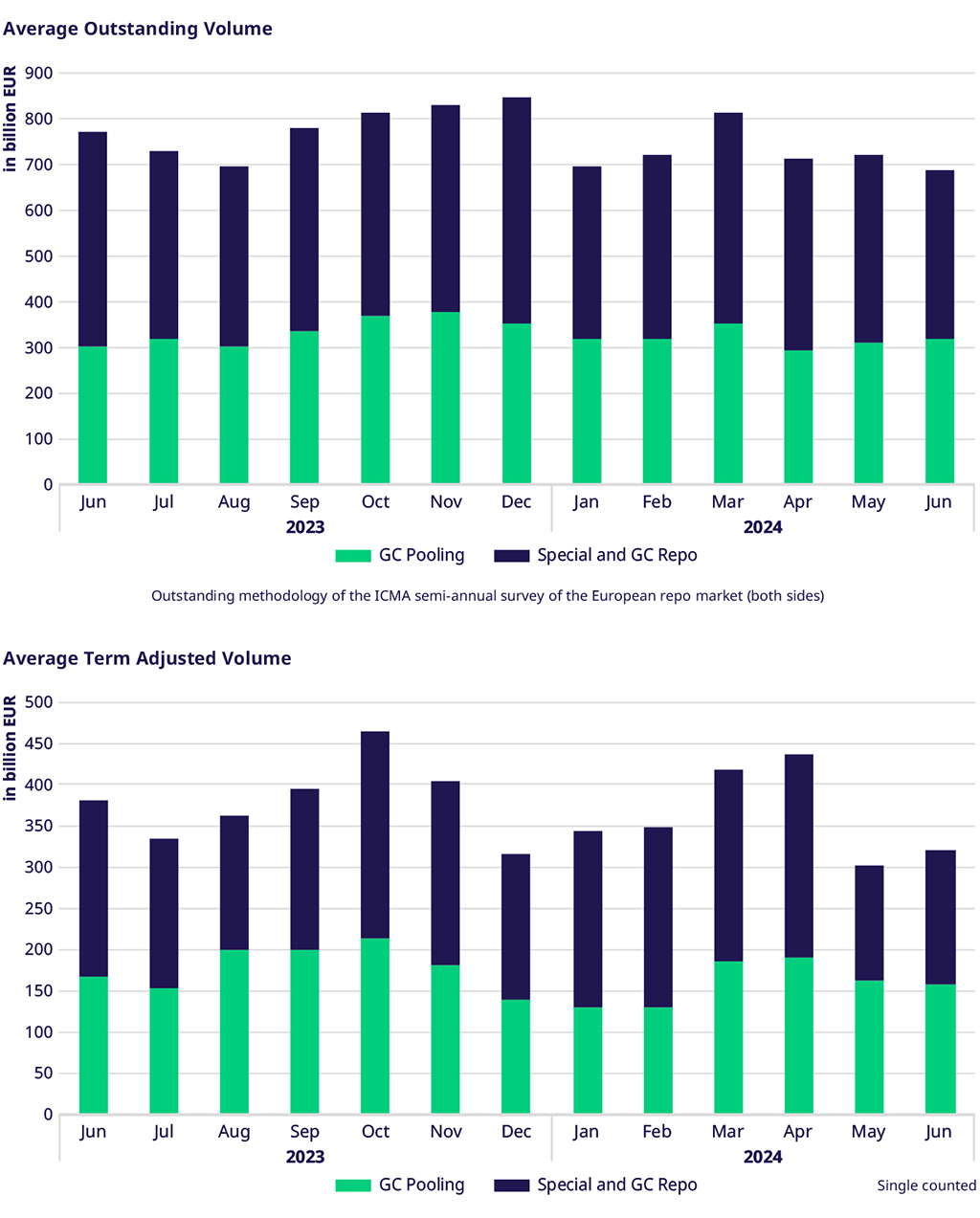

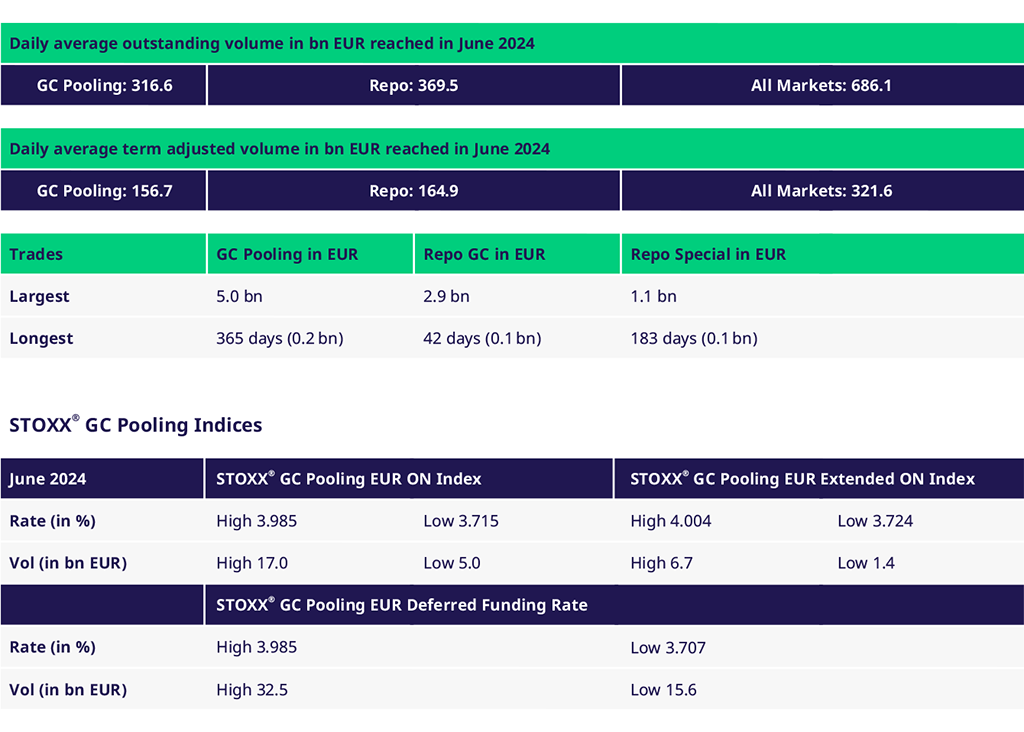

Eurex Repo enjoyed a busy month in July with plenty of term activity as clients digested the latest ECB Governing Council decisions and comments. They also started looking ahead to the policy decisions and liquidity conditions expected in the year's second half. This led to a robust rise in term-adjusted volume of 16% in July compared to June 2024. This volume was mainly driven by a 26% rise in Special Repo. The period from January to June 2024 showed continued growth of about 8% compared to the same period in 2023, with the GC Pooling market growing by 15% while Repo volumes edged upwards by around 2%.

Outstanding and Volumes

When comparing July 2024 to July 2023, the average outstanding volume across all market segments decreased by 8%. This was primarily driven by the Repo Market, which fell by around 9%. For the first seven months of this year, the average outstanding volume across all markets increased by 6.4% compared to the same period last year. This increase was driven by much higher outstanding volumes in GC Pooling (+24%).

Spreads and Collateral

July saw continued stability in short-term rates within the EUR GC Pooling Market. The average spread between the ECB and EXT ECB baskets remained within one basis point. At month end, we saw a temporary dip in Overnight term in both the ECB and EXT ECB baskets to a low point of 3.65%, which was slightly below ESTR and produced a spread to the trading days on either side of around 6bp. By comparison, the end of June saw only a drop of 3bp.

Eurex Term Repo

Trading activity in the standard terms ranging from one week to twelve months in EUR GC Pooling remained animated. Longer terms in nine and twelve months were particularly busy as longer-term ESTR rates began to fall. In the ECB basket, it was notable that the average repo rate of the 12-month term declined by around 22bp over the course of July.

In the Repo Market segment we saw continued animation in Euro government bond executions, particularly out to two and three-month terms.

Green Bonds

The GC Pooling Green Bonds basket continued its upward trajectory in terms of trade volumes and number of participants in the market, setting a new traded volume record slightly above EUR 10 billion for the month. The cleared volume has increased to €36 billion since its launch on 29 April, indicating a growing interest and demand for green bond investments within the market. Repo rates in the basket continued to average around 2bp below the ECB GC Pooling basket in Overnight and one-week terms.

News

🏆 Eurex is the European #Repo team of the Year!

We are thrilled to announce that Eurex Repo has been awarded last night, 11 July, the European Repo Team of the Year! 🚀

Our substantial growth in the Eurex repo markets, driven by our innovative product and sales initiatives, along with rising interest rates and reductions in excess liquidity, has helped us build the broadest global customer network for secured funding and financing. We are proud to have over 160 participants from 20 countries as part of our network.

A heartfelt thank you to our incredible team and valued clients and partners for making this achievement possible. Together, we are setting new standards in the repo market! 🙌

Events - save the date

Eurex Repo update roundtables:

📍 Frankfurt, 26 September

📍 New York, 3 October

📍Vienna, 3 October

Volumes

Participants: 165

View the current participant list

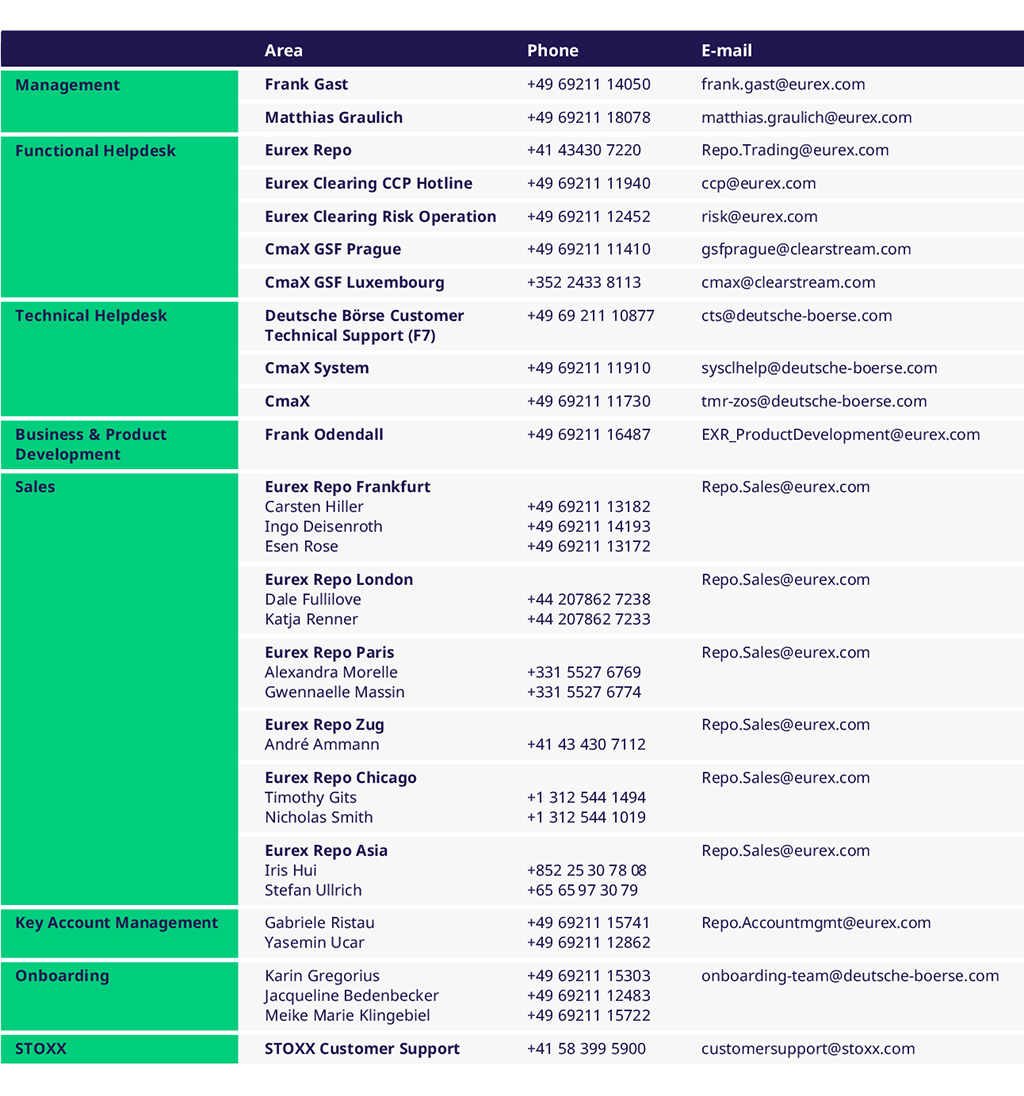

Services & Contacts