13 Jun 2024

Eurex

Eurex Repo Monthly News May 2024

Market briefing: ''Monetary policy uncertainty drives volumes in May 2024''

by Frank Gast - Managing Director, Member of the Management Board, Eurex Repo

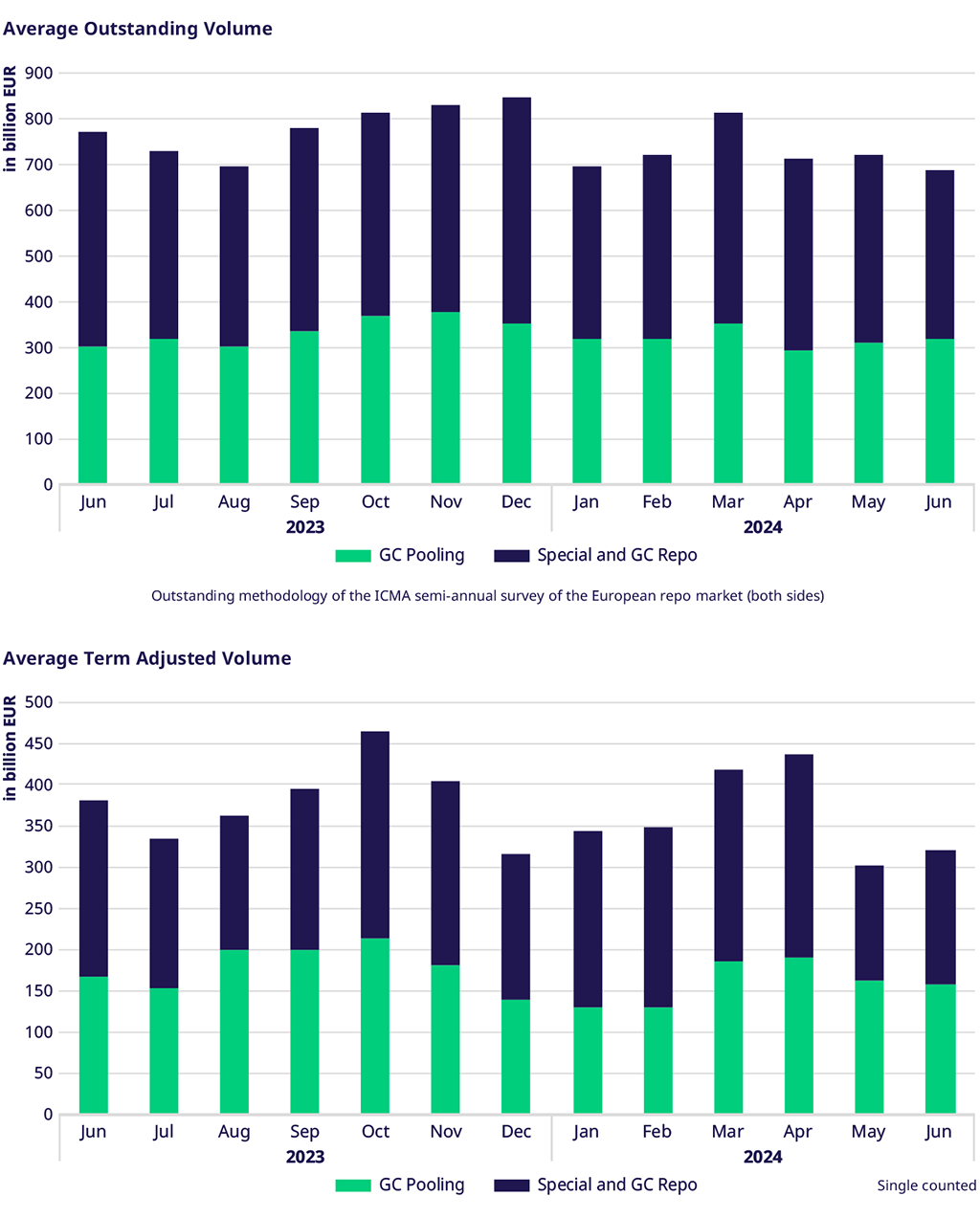

Eurex Repo average term-adjusted volume surges to an impressive €367 billion. This represents a robust 12% rise year-over-year. This growth was primarily driven by a 23.6% increase in GC Pooling volumes, which reached €159 billion. Meanwhile, the Repo segment remained stable, experiencing a 4.4% increase to €208 billion.

Outstanding and Volumes

Year-on-year, the average outstanding volume across all market segments rose by 14%. This increase is primarily driven by GC Pooling, which recorded remarkable growth of 38.6%. Specials & GC Repo, on the other hand, showed slight growth of 0.2%. The sustained demand for liquidity is particularly evident in the GC Pooling segment, which saw a significant 38.7% rise in average outstanding volume.

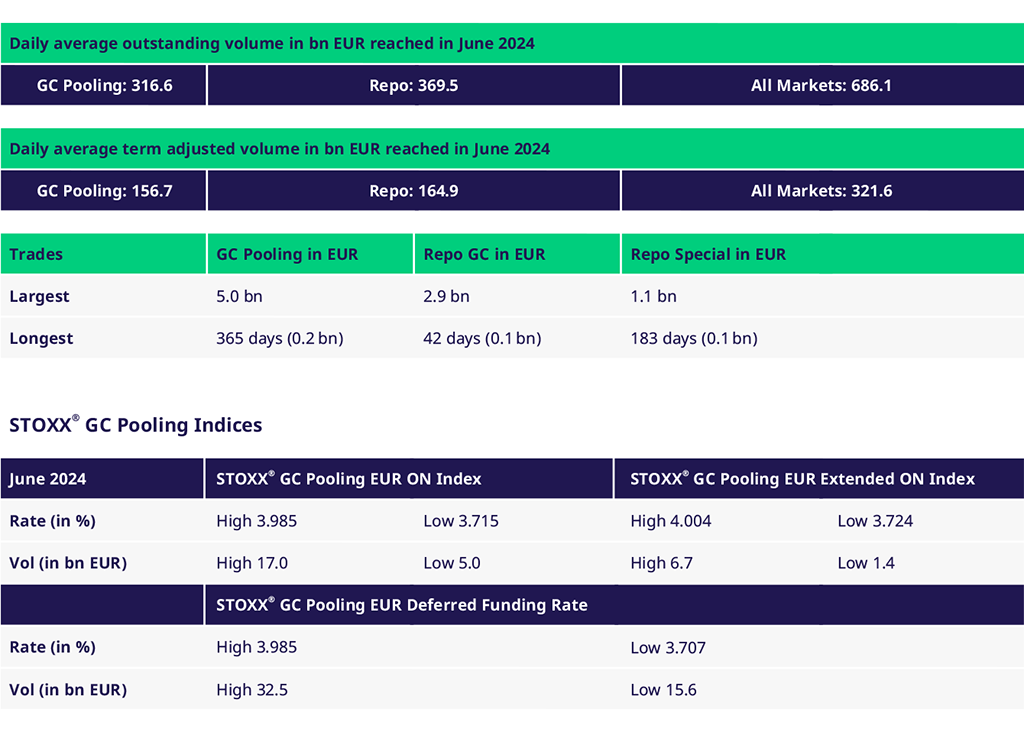

Spreads and Collateral

By month-end, GC Pooling ECB basket traded in overnight at 3.944% (-5.6 bps vs DFR) and the EXT basket at 3.954% (-4.6 bps vs DFR). The average spread between these two baskets further tightened to 1 basis point.

Eurex Term Repo

In the ECB and EXT ECB baskets, we observed strong trading activity across various terms—from one week to twelve months. Liquidity was abundant in long-term dates, particularly at 9 and 12 months, with tight spreads visible in the order book.

The Green Bond GC Pooling basket remained attractive in the market, with regular quotes in the order book for up to one week and a total cleared volume of around EUR 10 billion since the basket was launched on 29 April. Additionally, the INT MXQ GC Pooling basket continued to experience elevated volumes and order book quotes, primarily in the one-week to two-month term bucket. It remains popular for both EUR and USD cash settlement.

In the Specials / GC Repo segment, we noticed more than usual core and semi-core EUR Govie GC trades in term, culminating with the peak volume settlement date on June 12th.

We saw EUR 250 million of French Inflation-linked bonds trade out to 20th September in variable rate format vs ESTR.

Government Bonds

The traded volume of German government bonds in special repo transactions declined by 30% year-on-year due to market conditions. However, average outstanding volumes in Special & GC increased slightly by 0.2% year-over-year, indicating a shift in focus towards other eurozone government bonds - particularly those from France, Spain, and Italy. Additionally, active quotes in order books for Belgian, Austrian, and Finnish bonds contributed to higher overall trading.

EU Bonds and SSAs

EU bond trading surged, with volumes increasing nearly 50% compared to April. Overall SSA trading volumes also saw a significant increase, rising 17% from April's levels.

Events

Securities Finance Times Industry Excellence Awards

We are shortlisted as European Repo Team of the Year!

The Securities Finance Times Industry Excellence Awards are dedicated to supporting and recognizing talented and dedicated firms, individuals and departments across the industry. We are pleased to be shortlisted and look forward to 11 July for the annual award dinner at Plaisterers’ Hall, London.

Join us in Geneva for the Annual Securities Finance & Collateral Management Conference.

We are proud sponsors and look forward to meeting you on-site.

Volumes

Participants: 165

View the current participant list

Services & Contacts