Dec 13, 2024

Eurex

Eurex Repo Monthly News November 2024

Market briefing: ''Collateral hunts for cash in Eurex Repo Markets''

by Frank Gast - Managing Director, Member of the Management Board, Eurex Repo

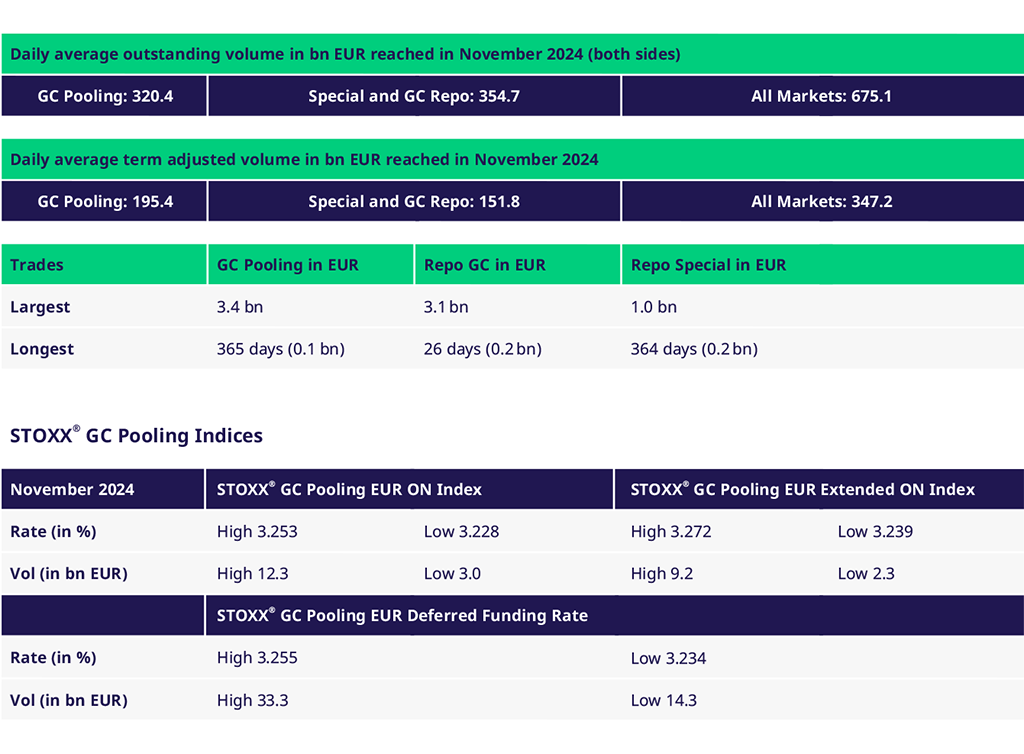

November 2024 marked a significant shift in the repo market dynamics, characterized by a transition from a cash-hunting-for-collateral environment to one where collateral is hunting for cash. This shift notably impacted the term business in both GC Pooling and the Special Repo market segments.

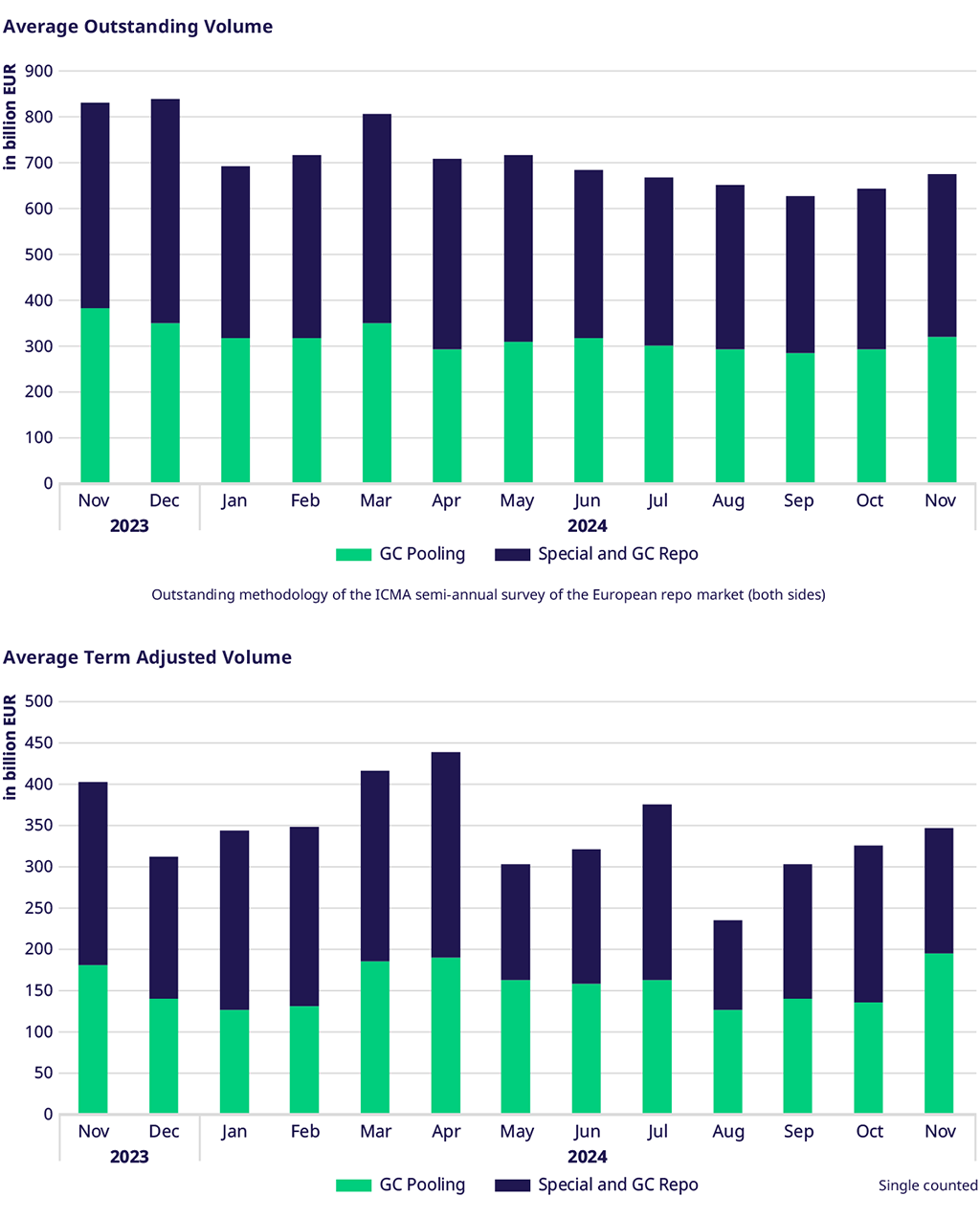

The average daily term-adjusted volume for all segments reached €347.2 billion, a 6% increase compared to October. GC Pooling demonstrated strong growth, with volumes rising to €195.4 billion daily average, a 42% increase from October. Conversely, GC & Special Repo experienced a 20% decrease in average term-adjusted volumes due to lower year-end activity in the Special market.

Outstanding and Traded Volumes

Average daily traded volumes slightly decreased by 3.5% year-over-year (YoY), with GC Pooling volumes increasing by 3.9% and Repo volumes decreasing by 12%. Overall, the Eurex average outstanding volumes remained robust with a slight YoY decrease of 2.9%, while GC Pooling continued to grow by 7.3%.

Spreads and Collateral

The average overnight rate spread between the ECB and ECB EXT baskets widened to 1.35 basis points, peaking at 2.3 basis points over the month-end. The ECB basket versus €STR spread narrowed to 7.5 basis points, while the ECB EXT basket spread remained nearly unchanged at 8.8 basis points. The spread between the ECB EXT Basket and the Deposit Facility Rate slightly widened to 0.3 basis points.

German "Bunds" and EU Bonds

Average trading volumes in Bunds decreased by 20% compared to last year, reflecting low demand and high supply, especially for short covering and less term business over the year-end. Notably, transactions covering the "turn" from 31 December to 2 January 2025, were executed at 3.45%, indicating a high funding premium. On the short end, levels for Bunds “richened” a bit compared to October with a spread of -11 bps to €STR (beginning of October -9bps).

Volumes in SSAs and EU bonds increased by 14% and 15% respectively compared to October, reaching the highest levels in 2024 due to higher trading activity in single ISINs/Special repo.

At the end of September, Eurex Repo successfully admitted the European Commission as a new trading member, with the first trades executed in October.

Eurex Term Repo

Overall term-adjusted volumes increased by 42% compared to October, driven by high term activity in the ECB basket with trades in standard terms up to 12 months and significant sizes in 6-month terms, with “break dates” to benefit from netting opportunities.

Despite lower term business in Special Repo compared to October, there were notable term trades in various government bonds, particularly in Bunds, French, and Italian bonds up to 6 months. Flex terms also saw significant activity, with OATS trading with break dates for 12 months at around 2.36%.

Green Bonds

The GC Pooling Green Bond Basket continued to attract interest, with average daily outstanding volumes growing to €700 million.

Events - save the date

GFF Summit | Navigating Uncertainty: Geopolitics and Market Dynamics

📍 European Convention Center Luxembourg | 29-30 January 2025

Interested ? Reach out to our Eurex Repo team for your invitation in case you haven’t received an invite yet. We look forward to seeing you in Luxembourg in January!

Volumes

| |||

|

Participants: 165