13 Nov 2024

Eurex

Eurex Repo Monthly News October 2024

Market briefing: ''Eurex Repo showcased resilience and growth in October''

by Frank Gast - Managing Director, Member of the Management Board, Eurex Repo

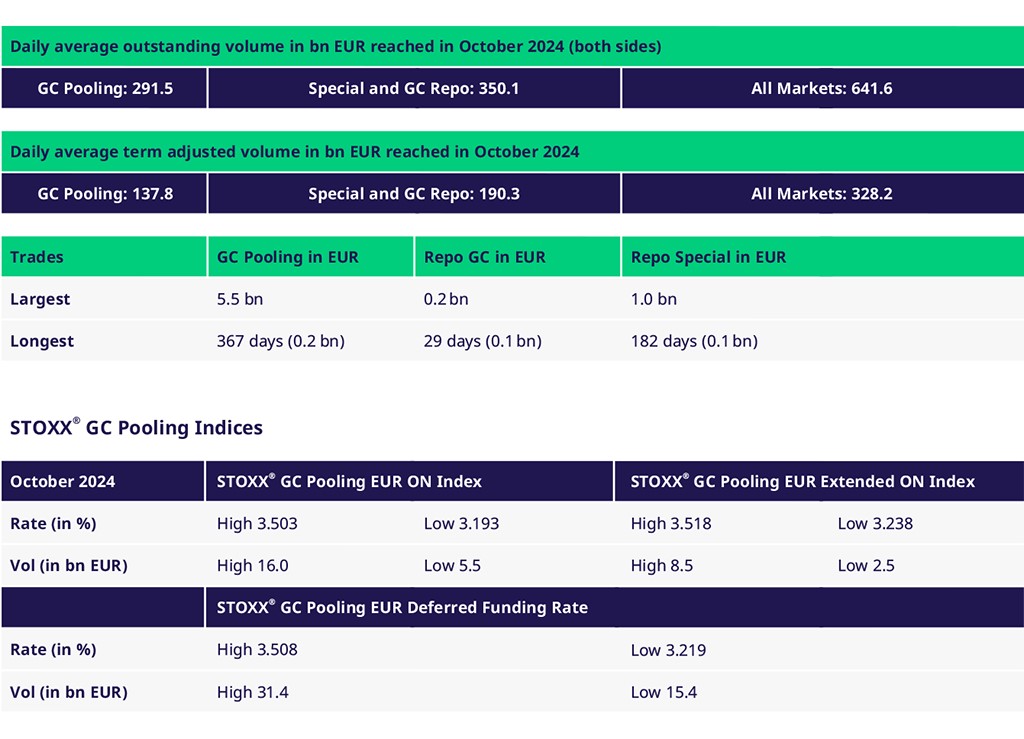

In October, the ECB implemented a 25-basis point rate cut, leading to increased fluctuations in repo market volumes and higher trading activity. This rate cut influenced market rates, with the overnight and term repo rates adjusting accordingly, reflecting the market’s adaptation to the new monetary policy.

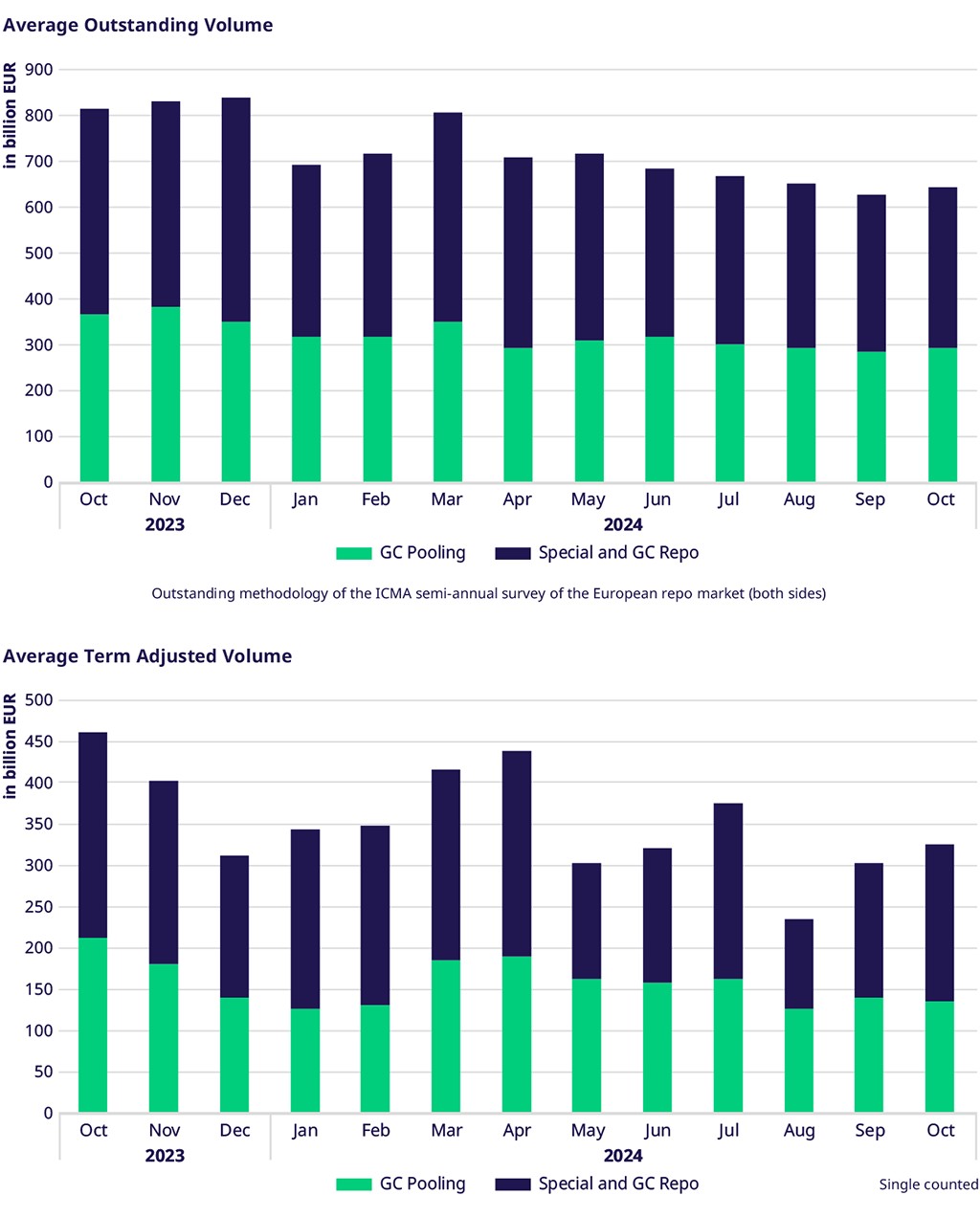

Eurex Repo demonstrated resilience and adaptability in October despite a challenging market environment. The average term-adjusted volume for all segments was 328.2 billion euros, reflecting a robust market presence. Notably, the GC Pooling segment maintained a significant volume of 137.9 billion euros, showcasing its stability.

Compared to September, the term-adjusted volume increased by approximately 8%, highlighting a strong recovery and growth momentum.

Additionally, from January to October 2024, the average term-adjusted volume across all segments was 341 billion euros, a minor decrease of only 4.8% YoY.

Outstanding and Traded Volumes

Average daily traded volumes increased by 4% compared to September, mainly driven by an 8% increase in GC Pooling volumes. The average outstanding volume decreased YoY by 1% overall, whereas GC Pooling's outstanding volume grew by more than 10% YoY.

Spreads and Collateral

The average overnight rate spread between the ECB and ECB EXT baskets slightly widened compared to September to around 1.1 basis points. The spread between the ECB basket and the €STR fixing narrowed to 7.7 basis points. The ECB EXT basket traded, on average, slightly above the deposit facility rate. The average spread between the ECB EXT basket and the deposit facility rate widened to 0.2 basis points. Over the month-end, GC Pooling overnight rates traded slightly lower, with an average in the ECB basket at 3.19% and 3.24% in the ECB EXT basket.

German "Bunds" and EU Bonds

German “Bunds” average daily traded volume declined by 21% compared to October 2023, reflecting decreased demand to cover Bunds over year-end in contrast to previous years. However, this represents a smaller decline of 8.47% compared to September 2024, indicating a stabilizing trend. This follows the strong recovery in September, where average daily traded volumes increased by 35% compared to August.

Trading volumes in Supranationals & Agencies increased by 30% compared to September and by 43% compared to October last year.

Volumes in EU bonds were down by 10% compared to September but 7% higher than in October last year. In addition to the traded volumes in GC & Special Repo, we allocated around EUR 9 billion of EU bonds in GC Pooling.

At the end of September, Eurex Repo successfully admitted the European Commission as a new trading member, with the first trades executed in October.

Eurex Term Repo

In October, we saw very good term business in standard terms up to twelve months, mainly in the ECB and ECB EXT baskets. The 12-month ECB basket traded between 2.59% and 2.67%. Most term business in GC Pooling traded in 1-month terms, equally distributed between the ECB, ECB EXT and IntMXQ baskets.

In Special Repo, year-end preparations started with huge trading volumes in the 3-month terms, mainly in French and Italian Government bonds. Contrary to previous years, where collateral scarcity and demand for bonds drove rates lower over year-end, this year is different. With plenty of collateral in the market, refinancing pressure over year-end pushes rates higher. EUR govies traded in 3-month terms between €STR +10-15, implying a triple-digit spread versus €STR over the 2-day year-end turn.

Green Bonds

October was a record-breaking month for our GC Pooling Green Bond Basket, with cleared volumes reaching an impressive €120 billion since its launch at the end of April. This milestone underscores the growing importance of sustainable finance and the robust demand for green collateral in the repo market.

Volumes

| |||

|

Participants: 165