30 Oct 2024

Eurex

Eurex Repo Monthly News September 2024

Market briefing: ''Eurex Repo experienced strong increase in term-adjusted volumes in September''

by Frank Gast - Managing Director, Member of the Management Board, Eurex Repo

At the beginning of September, the market was in a holding pattern, awaiting the European Central Bank (ECB) meeting on September 12. The anticipated rate cut by the ECB had been priced in by the market for some time, so its announcement came as no surprise.

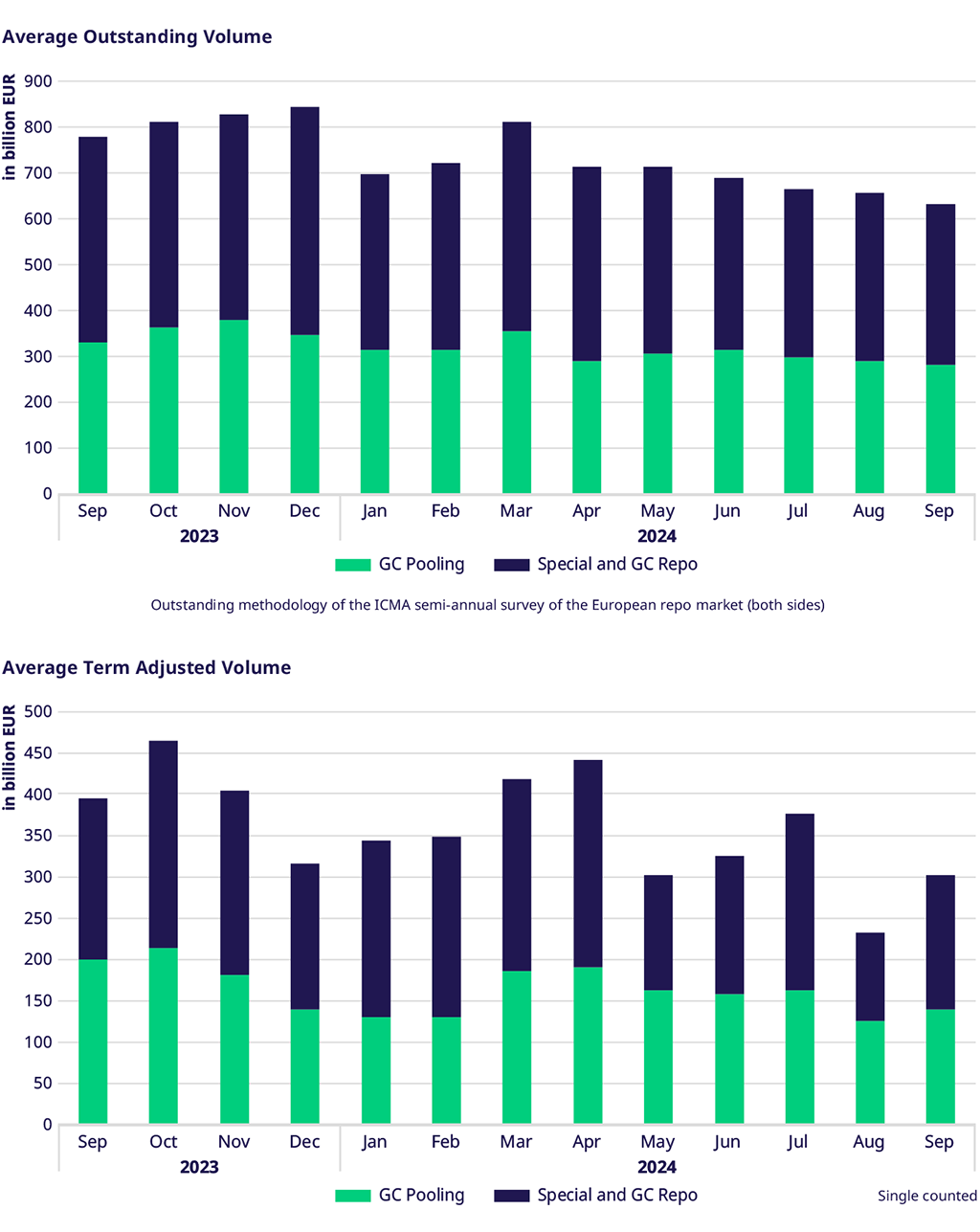

The overall term-adjusted volume decreased slightly by 1% compared to the first nine months of the previous year. This decline was primarily due to a 2.4% reduction in term volume within the GC and Special repo market segments, although the GC Pooling term volume saw a modest increase of 0.7%.

In contrast, Eurex Repo experienced a significant 30% increase in term-adjusted volumes compared to August. This growth was driven by a 57% rise in term activity within the Special repo market segment and an 11% increase in GC Pooling term volume.

Outstanding and Traded Volumes

Comparing Q3 2024 to Q3 2023, the average outstanding volume across all market segments fell by 10.6%, largely due to a 13% drop in the Repo market. However, from January to September, the overall outstanding volume was still 2% higher than the same period last year, with GC Pooling outstanding volume up by 15%.

Average daily traded volumes were slightly down year-on-year (-2.8%), mainly due to reduced trading in the Repo market. Conversely, GC Pooling volumes increased by nearly 3%. USD GC Pooling showed improved liquidity, with traded volumes reaching almost $4.5 billion, primarily in short-term maturities up to one month.

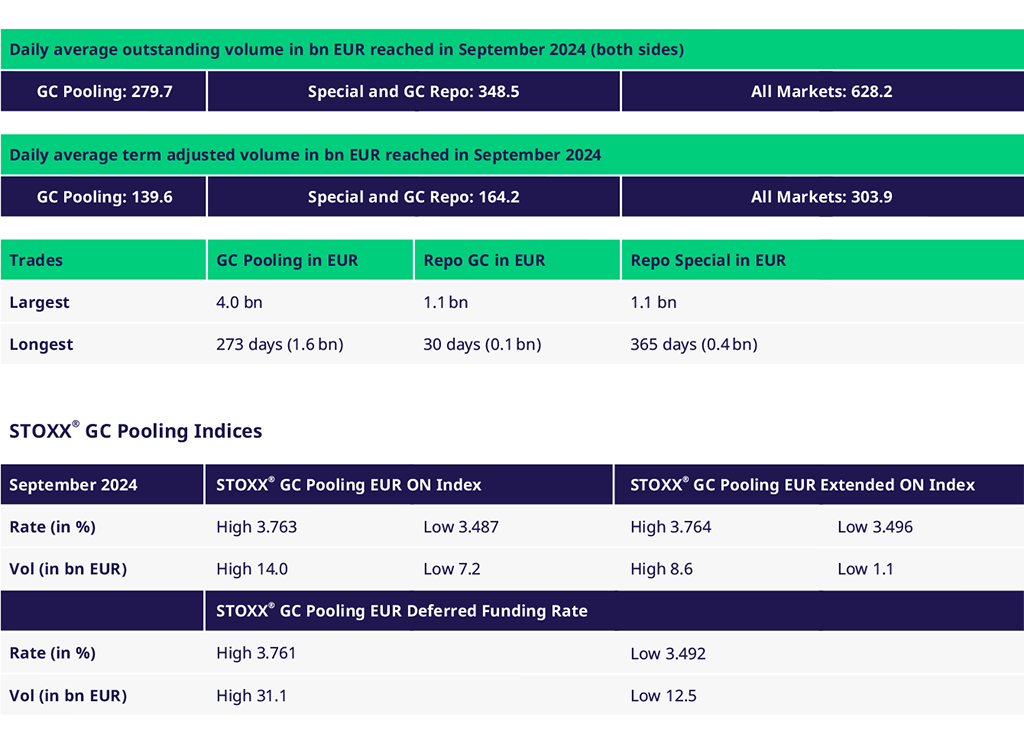

Spreads and Collateral

The average overnight rate spread between the ECB and ECB EXT baskets remained tight at around 0.6 basis points. Meanwhile, the spread between the ECB basket and the €STR fixing widened to 8 basis points. The ECB EXT traded on average flat against the deposit facility rate, occasionally trading slightly above it. The quarter-end was smooth, with GC Pooling overnight rates on average at 3.49% in the ECB basket (between 3.46% and 3.60%) and 3.50% in the ECB EXT basket (between 3.50% and 3.60%).

German "Bunds" and EU Bonds

German “Bunds” saw a strong recovery in September, with average daily traded volumes up by 36% compared to August. While trading volumes for the first nine months were still below last year’s levels, September 2024 marked the first month where “Bunds” traded higher than the same month in 2023. The trend of “cheapening” in German government bonds continued post-rate cut, with spot next rates averaging around €STR flat.

EU Bonds also experienced a robust recovery, with traded volumes increasing by 65% compared to August. Although average traded volumes in 2024 were slightly below the previous year’s average, they were still five times higher than in 2022.

Eurex Term Repo

The increase in term-adjusted volumes in GC Pooling was mainly due to term trades in 9 and 12-month maturities within both the GC Pooling ECB and ECB EXT baskets. Significant volumes of 12-month maturity trades were also executed using the break trades order type.

In the Special repo market segment, Euro Government Bonds saw active trading with maturities extending up to 12 months, covering netting dates in October, December, and January 2025.

Green Bonds

The GC Pooling Green Bonds basket continued its upward trend in trade volumes and market participation, setting a new record with traded volumes slightly above EUR 11 billion for the month. The total cleared volume since its launch on April 29 has reached €92 billion, reflecting growing interest and demand for green bond investments. Repo rates in this basket averaged around 2 basis points below the ECB GC Pooling basket for overnight and one-week terms.

Events - save the date

Eurex continued hosting its inaugural repo roundtables this year with Part II, in a sign of both its central role in European cleared repo markets and the increasingly important role those markets are playing for the continent's funding needs.

Join our next Eurex Repo roundtable:

📍 Vienna, 24 October

Interested? Reach out to our sales team Eurex Repo

EU Commission joins Eurex's repo market

The EU Commission (EC) is the latest member to join the Eurex Repo segment bringing the number of participants to 165 - including 10 Supranational Institutions and Agencies as well as 5 central banks such as Deutsche Bundesbank. Both institutions announced that the EU Commission is ready to trade and clear repo transactions at Eurex. This is a major milestone for Eurex as both a leading marketplace for derivatives and repo trading and at the same time one of the leading clearing houses globally, to become the incumbent marketplace for trading and clearing of euro-denominated repo and derivatives transactions.

Volumes

Participants: 165