T7 Release 11.1

With T7 Release 11.1 following enhancements will be introduced:

- Submission of Anonymous Baskets trades

- End Client Disclosure

- Introduction of a Fee Code

- Eurex Improve via FIX LF

- ETI Password Encryption

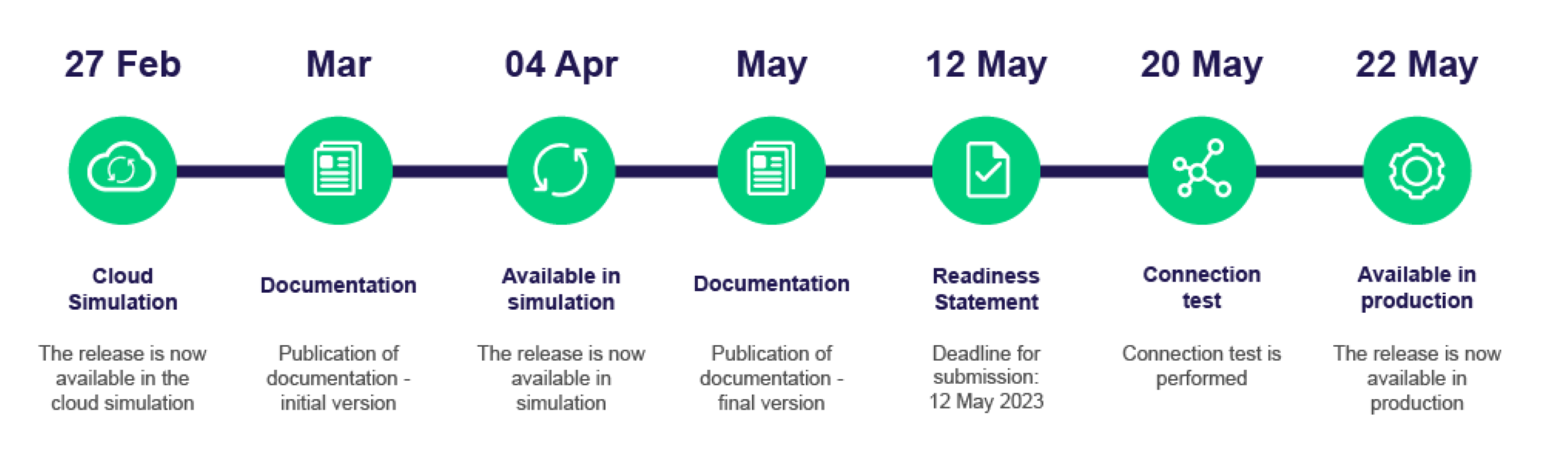

Simulation start: 04 April 2023

Production start: 22 May 2023

System Documentation

- T7 Release 11.1 - Final Functional Technical Release Notes Eurex v.1.1

Published 20 Mar 2023 - The release notes for T7 give an overview of the functional and technical enhancements and changes to be introduced. - T7 Release 11.1- Functional Reference v.11.1.2

Published 20 Mar 2023 - This document provides a detailed insight into the functional concepts of the T7 trading architecture. - T7 Release 11.1 - Function and Interface Overview v.11.1.2

Published 20 Mar 2023 - The document provides an overview of T7. It describes the major functional and system features, and provides a high level description of the interface landscape. - T7 Cross System Traceability v.11.1-1.0

Published 20 Mar 2023 - This document contains detailed information on order, quote and trade traceability across trading and clearing systems focusing on the markets XEUR (Eurex Frankfurt) and XETR (Xetra Frankfurt). - Fee Identification Code – User Guide

Published 06 Mar 2023 - This document provides an overview of the different values a Fee Identification Code can take and outlines examples on how to use this information.

Enhanced Trading Interface

- T7 Release 11.1 - Enhanced Trading Interface (ETI) - Manual v.1.2

Published 08 May 2023 - The document provides information relating to the T7 Enhanced Trading Interface (ETI) and contains a detailed description of the concepts and the messages used by the interface for both the Cash and Derivatives Markets. - T7 Enhanced Trading Interface - Derivatives Message Reference v.11.1-D0003

Published 08 May 2023 - This document provides a reference to all message formats for the Enhanced Trading Interface derivatives markets. - T7 Enhanced Trading Interface - Cash Message Reference v.11.1-C0003

Published 08 May 2023 - This document provides a reference to all message formats for the Enhanced Trading Interface cash markets. - T7 Release 11.1 Enhanced Trading Interface - XSD XML representation and layouts v.1.2

Published 08 May 2023 - The package contains the XML representation and the schema files for the Enhanced Trading Interface (ETI) for both the Cash and Derivatives Markets. - T7 Production Public Key for ETI password encryption [sequence no. 1]

Published 20 May 2023 - Public key for ETI session and user login with password encryption. - T7 Simulation Public Key for ETI password encryption [sequence no. 1]

Published 05 Apr 2023 - Public key for ETI session and user login with password encryption.

FIX LF

T7 Release 11.1 - FIX LF Manual v.1.2

Published 08 May 2023 - The document provides information on the T7 FIX LF interface for both the Cash and Derivatives Markets and contains a description of the conncectivity, concepts and messages used by FIX LF.T7 FIX LF Interface - Derivatives Message Reference v.11.1-D0003

Published 08 May 2023 - The purpose of this document is to provide all message formats for the derivatives markets part of the FIX LF interface.T7 FIX LF Interface - Cash Message Reference v.11.1-C0003

Published 08 May 2023 - The purpose of this document is to provide all message formats for the cash markets part of the FIX LF interface.T7 Release 11.1 - FIX LF XSD XML representation and layouts v.1.2

Published 08 May 2023 - The package contains the QuickFix Engine dictionaries (FIXLF44_Derivatives.xml, FIXLF44_Cash.xml) and message reference files including message and field descriptions (FIXLF_DerivativesExt.xml, FIXLF_CashExt.xml) for the T7 FIX LF interface per marketplace type.

STEP (Sample Tool for ETI Password Encryption)

By downloading the script STEP (Sample Tool for ETI Password) from the link below, you agree, and if you are acting on behalf of a third person you agree on behalf of that person, to the following terms of use of Deutsche Börse AG and Eurex Frankfurt AG, both 60485 Frankfurt am Main, Germany (individually and collectively “DB”),

- STEP is only an example implementation to illustrate the ETI password encryption protocol, it is intended and may be used for educational purposes only.

- DB does not make any representation, warranty, or guarantee in relation to STEP and any representation, warranty or guarantee, whether express nor implied is explicitly disclaimed.

- (a) DB is fully liable for damage due to (i) injury to life, limb or health, (ii) intent or gross negligence, and (iii) assumption of a guarantee. (b) Liability for damages caused by employees or agents of DB who are not officers or executives of DB is restricted to the damage typical for this kind of agreement and foreseeable at the time of the conclusion of the agreement. Liability for simple (slight) negligence is excluded. This does not apply to damages resulting from the violation of essential contractual obligations. Essential contract obligations are obligations the fulfilment of which is necessary for the proper execution of the contract, and on whose fulfilment the other party may rely and is relying. (c) The aforementioned limitation of liability also applies to damage claims against officers, executives, employees or vicarious agents of DB.

- Any amendments to this agreement require the written form, which shall also be required for amending this written form clause.

- This Agreement shall be governed by the laws of the Federal Republic of Germany, excluding its conflict of laws principle, the United Nations Convention on Contracts for the International Sale of Goods shall not be applicable.

- The courts of Frankfurt am Main shall have exclusive jurisdiction over any dispute relating to this agreement or STEP that may be prorogated.

- T7 EMDI_MDI_RDI_Manual_v.11.1.1

Published 08 May 2023 - The document provides information relating to the market and reference data interfaces (EMDI, MDI, RDI and RDF) and contains a detailed description of the concepts and messages used by the interfaces. - T7 EMDI_MDI_RDI_XML_Representation_v.11.1.1

Published 08 May 2023 - The package contains the XML FAST template files (FAST 1.1 and 1.2) and FIXML schema files for the T7 market and reference data interfaces (EMDI, MDI and RDI). - T7 Enhanced Order Book Interface Manual v.11.1.0

Published 08 May 2023 - The document provides information relating to the T7 Enhanced Order Book Interface (EOBI) and contains a detailed description of the concepts and messages used by the interfaces. - T7 Enhanced Order Book Interface - XML Representation v.11.1.0

Published 08 May 2023 - The package contains the XML representation and the schema files for the T7 Enhanced Order Book Interface (EOBI). - Extended Market Data Service Trade Prices, Settlement Prices and Open Interest Data Manual v.11.11

Published 08 May 2023 - The document provides information relating to the market and reference data interfaces (EMDI, MDI, RDI and RDF) and contains a detailed description of the concepts and messages used by the interfaces. - Extended Market Data Service - XML FAST Templates - FIXML schema files v.11.11

Published 08 May 2023 - The package contains the XML FAST template files (FAST 1.1 and 1.2) and FIXML schema files for the T7 market and reference data interfaces (EMDI, MDI and RDI). - Extended Market Data Service - Underlying Ticker - Manual v.11.11

Published 08 May 2023 - This document provides the information about the Underlying Ticker service for T7. - Extended Market Data Service - Underlying Ticker Service - XML FAST Templates v.11.11

Published 08 May 2023 - This document provides the XML FAST templates for the Underlying Ticker service for T7.

- T7 Derivatives Markets - T7 Trader, Admin and Clearer GUI v.11.1.3

Published 08 May 2023 - This document provides information on the T7 Derivatives Markets GUI solutions, the Trader-, Admin- and Clearer GUI for T7. All views and functions of the T7 Derivatives Markets GUIs are described. - T7 Cash Markets - T7 Trader, Admin and Clearer GUI v.11.1.1

Published 08 May - This document provides information on the T7 Cash Markets GUI solutions, the Trader-, Admin- and Clearer GUI for T7. All views and functions of the T7 Cash Markets GUIs are described. - T7 Trader GUI, Admin GUI and Clearer GUI - Installation Manual v.11.1.0

Published 20 Mar 2023 - This document provides information on Deutsche Börse's T7 GUI solutions, the T7 Trader GUI, T7 Admin GUI and T7 Clearer GUI from a technical point of view. The document explains how to establish connection to Deutsche Börse's T7 with the GUI solutions. - T7 Derivatives Market Eurex - Participant and User Maintenance Manual v.1.1

Published 20 Mar 2023 - This manual is intended to assist service administrators who are responsible for maintaining participant and user related data in T7. - T7 Cash Markets - Xetra and Börse Frankfurt: Participant and User Maintenance Manual v.1.1

Published 20 Mar 2023 - This manual is intended to assist service administrators who are responsible for maintaining participant and user related data in T7. - T7 Derivatives Markets Gui Whats New v.11.1.2

Publication date: 27 Mar 2023 - This document provides compact information of the new GUI related features for the release. - T7 Cash Markets Gui Whats New v.11.1.1

Publication date: 27 Mar 2023 - This document provides compact information of the new GUI related features for the release.

- T7 Disaster Recovery Concept 2023 - Interface Configuration Details v.1.1

Published 15 May 2023 - This document provides an overview of Deutsche Börse’s disaster recovery concept for the T7 trading system. It contains the required technical background information as well as functional features and limitations to enable participants to continue trading in a DR situation. - N7_-_Network_Access_Guide.v.2.2.6

Published 25 May 2023 - This document provides details on the network access options for T7 and Eurex Clearing's interfaces. It includes detailed technical background information, such as router equipment information and port numbers for the configuration of firewalls. - T7 Market Data Report Derivatives 2023-05-31

Published 2 Jun 2023 - This file contains for one specific date (Frankfurt time) the number of packets per multicast address and port combination enhanced with the stream and market information. Please note that the number of packets varies per day and the “From” and “To” columns contain the first and last minute where data was received on that day for the respective combination. - T7 Market Data Report Cash 2023-05-31

Published 2 Jun 2023 - This file contains for one specific date (Frankfurt time) the number of packets per multicast address and port combination enhanced with the stream and market information. Please note that the number of packets varies per day and the “From” and “To” columns contain the first and last minute where data was received on that day for the respective combination. - T7 Market Data Report Derivatives 2023-03-28

Published 31 Mar 2023 - This file contains for one specific date (Frankfurt time) the number of packets per multicast address and port combination enhanced with the stream and market information. Please note that the number of packets varies per day and the “From” and “To” columns contain the first and last minute where data was received on that day for the respective combination. - T7 Market Data Report Cash 2023-03-28

Published 31 Mar 2023 - This file contains for one specific date (Frankfurt time) the number of packets per multicast address and port combination enhanced with the stream and market information. Please note that the number of packets varies per day and the “From” and “To” columns contain the first and last minute where data was received on that day for the respective combination.

- T7 XML Report Reference Manual v.111.3.1

Published 08 May 2023 - This document describes all reports based on T7 trading data for both the cash and derivatives markets. - T7 XML Report Manual Modification Notes v.111.3.1

Published 08 May 2023 - This document provides an overview of the enhancements and changes to the T7 XML Reports as compared to the previous version. - T7 Reports - XML Schema Files v.111.3.1

Published 08 May 2023 - This package contains the reports xsd files for T7 cash markets and derivatives markets reports. - Common Report & Upload Engine User Guide - version March 2023

Published 20 Mar 2023 - The Common Report Engine allows the centralised provisioning of reports and the Common Upload Engine the upload of files. The manual contains everything from access information to the CRE & CUE and report/file naming conventions for CRE.

- T7 Release 11.1 - Participant Simulation Guide v.1.0

Published 20 Mar 2023 - This document describes the timeline, new and changed features as well as the simulation focus days for this T7 release. Please use this document to plan and prepare your T7 Release simulation participation. - Known Limitations for T7 Release 11.1 Simulation v.1.2

Published 27 Apr 2023 - This document lists the current known limitations for the T7 Release simulation. - T7 Release 11.1 - Trading Parameters (Simulation)

Published 26 Apr 2023 - This file contains the trading parameters for the T7 Release 11.1 simulation environment.

- T7 Incident Handling Guide v.5.3

Published 02 May 2023 - This document provides a detailed description of the reaction of Deutsche Börse's T7 trading system to technical incidents and provides best practices for handling them. In addition the document provides references to the respective focus days in the T7 simulation environment which are intended to simulate such incidents.

- T7 Release 11.1 - Managing Fee Complexity (Fee Identification Code) & Buy-side Trading Disclosure

Publication date: 10 May 2023 - T7 Release 11.1 - Presentation

Publication date 20 Mar 2023

Circulars

Circulars

- Eurex Circular 033/23 T7 Release 11.1: Important information for production start

- Eurex Circular 020/23 Eurex T7 Functionality activations after official Release Dates

- Eurex Circular 028/23 Eurex Exchange’s T7 Disaster Recovery Test on 17 June 2023

- Eurex Circular 004/23 Next Generation ETD Contracts: Postponement of introduction date

- Eurex Circular: Announcement of T7 Release 11.1

Newsflashes

- Eurex Exchange Readiness Newsflash | REMINDER: Withdrawal of the unencrypted ETI LF connectivity options in simulation on 4 August 2023

- Eurex Exchange Readiness Newsflash | REMINDER: T7 Release 11.1 – Readiness Statement available

- Eurex Exchange Readiness Newsflash | T7 Release 11.1 – Publication of Final Release Notes and further documentation

- Eurex Exchange Readiness Newsflash | T7 Release 11.1 – Readiness Statement available

FAQ

No, there will be no differentiation in fees.

The same as now.

When Eurex decommissions the current billing infrastructure (ETA Q4 2024).

Yes, the correct value will be sent also for historical transactions after 5 June when the new fee report CB002 kicks in.

With C7 Release 9.1 CB002 will be provided in the usual report format. There are currently no plans to publish CB002 via API. RestAPI will not be supported by Eurex, instead any API development will be based on GraphQL API.

New field FeeIdntCode to be implemented if applicable.

The entity that we expect to register is the one who does the trading and is operationally involved with trading and dealing activities and that speaks directly with the execution broker. Only investment manager level needs registering, not the individual funds underneath.

No. The end client is invited to register themselves via Member section. A registration functionality will be available by the end of 2023. During registration, you will have to select one or more participating Brokers (Eurex Members) who will ID-tag your orders towards Eurex.

The Eurex Buy-Side Client is expected to tag their complete Eurex order flow, even for products which are currently not in scope of the disclosed fee. In the mid term, it is expected to introduce fee differentiation for most Eurex products.

With the introduction of the fee differentiation, disclosed trades will pay a lower fee than today, and non-disclosed trades will pay a higher fee.

Yes. On the Execution Broker level, the globally unique Client ID (LEI) ensure that the Eurex Buy-Side Client is identifiable to Eurex, regardless which Broker the order arrives through.

On the Clearing Broker level, the fees will be charged based on the Fee Code. Therefore, regardless of the Execution Broker and the Clearing Broker, if the transaction is disclosed, finally settled on the A-Account (and if the other requirements apply), the disclosed fee will be charged.

It is the Executing Broker's responsibility to flag the trade correctly ex-ante. If the trade is not correctly flagged, Eurex will take it as a non-disclosed trade and charge as such.

The new fee levels will be published as soon as they have been approved by our management. We envisage this to be somewhen after the 2023 summer break.

As we are interested in the identity of the end client, it should be down to the end clients to register, not to your affiliates. We also plan to introduce a provision in our Terms & Conditions that should prohibit affiliates of Eurex trading members to become Buy-Side Clients.

Readiness Statement

We kindly ask all Trading Members and ISVs to submit the Readiness Statement for T7 Release 11.1 by Friday, 12 May 2023 latest. Please note, that all trading participants are required to provide the Readiness Statement. For your convenience a online submission process has been introduced. The online Readiness Statement for T7 Release 11.1 is here available: Readiness Statement. Please enter your dedicated Eurex PIN in the online questionnaire. The PIN for your company has been sent to the Central Coordinator.

Readiness Videos

Release Items/Participants Requirements

Feature/Enhancement | Details | Action Item |

Fee Code Introduction | Eurex will provide fee relevant information in a transparent and comprehensive way to Trading Participants, so that Trading Participants can use that information to manage and calculate fees directly. The new fee code will allow Trading Participants to lookup the applicable fee information. | Trading Members need to adapt to these changes and perform sufficient testing. |

End Client Disclosure | Trading Participants performing DMA or ORS will be able to disclose the beneficiary owner in order messages towards the exchange allowing for fee differentiation. | Trading Members need to adapt to these changes and perform sufficient testing. |

Password Encryption for ETI | Eurex will provide an addition login option for sessions and users for T7 ET) with a password padded by the current UTC timestamp, encrypted with Deutsche Börse’s public RSA key, and base64 encoded. | Trading Members need to adapt to these changes and perform sufficient testing. |

Submission of Anonymous Baskets trades | Eurex will provide the possibility for the submissions of basket trades flagged as anonymous by the initiating broker. | Trading Members intending to use this functionality should perform sufficient testing. |

Eurex Improve via FIXLF | Eurex´ Improve functionality can be used also via FIX LF. | Trading Members that intending to use this functionality should perform sufficient testing. |

Eurex Initiatives Lifecycle

From the announcement till the rollout, all phases of the Eurex initiatives outlined on one page! Get an overview here and find other useful resources.

Contacts

Eurex Frankfurt AG

Release Competence Center

Service times from Monday 09:00 – Friday 18:00 CET

(no service on Saturday and Sunday)

Are you looking for information on a previous initiative? We have stored information about our previous initiatives in our Archive for you!