ORS Trader Identification Obligation

As of 22 November 2021, Eurex will introduce an identification obligation for Eurex Exchange traders when submitting an order via Order Routing System (ORS).

Please note: The usage of an ORS by internal employees/trading assistants of the ORS provider who are not admitted as Eurex Exchange traders is not allowed according to §19(1) of the German Exchange Act.

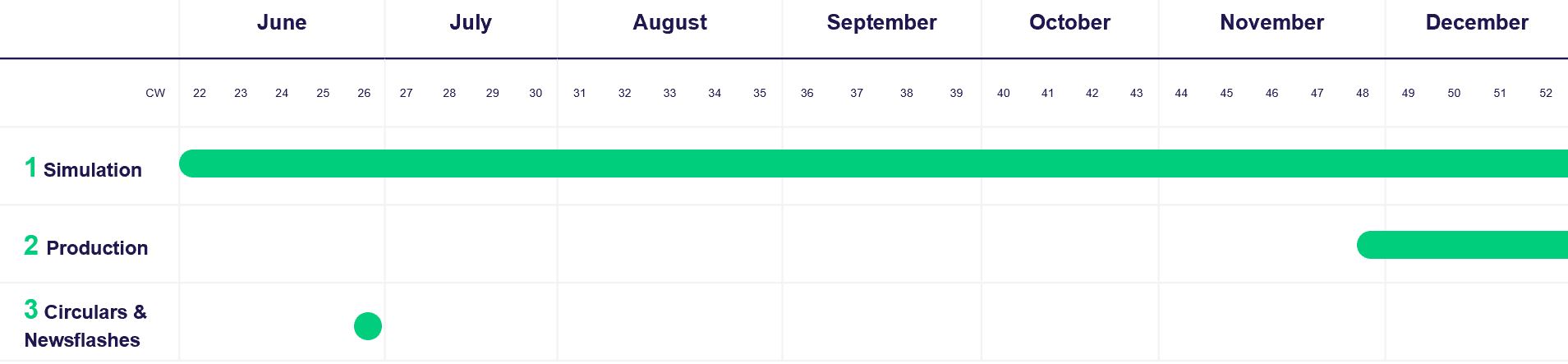

Simulation start: already available

Production start: 22 November 2021

System Documentation

- T7 Release 10.0 - Final Functional Technical Release Notes Eurex v.1.1

Published 4 Nov 2021 - The release notes for T7 give an overview of the functional and technical enhancements and changes to be introduced. - T7 Release 10.0- Functional Reference v.10.0.4

Published 4 Nov 2021 - This document provides a detailed insight into the functional concepts of the T7 trading architecture. - T7 Release 10.0 - Function and Interface Overview v.10.0.3

Published 30 Aug 2021 - The document provides an overview of T7. It describes the major functional and system features, and provides a high level description of the interface landscape. - T7 Cross System Traceability v.10.0-1.0

Published 30 Aug 2021 - This document contains detailed information on order, quote and trade traceability across trading and clearing systems focusing on the markets XEUR (Eurex Frankfurt) and XETR (Xetra Frankfurt).

Enhanced Trading Interface

- T7 Release 10.0 - Enhanced Trading Interface (ETI) - Manual v.1.3

Published 26 Nov 2021 - The document provides information relating to the T7 Enhanced Trading Interface (ETI) and contains a detailed description of the concepts and the messages used by the interface for both the Cash and Derivatives Markets.

Please note: In the Quote Execution Notification with T7 Release 10.0, the value of QuoteEventType (28539) has changed from 3 (Removed Quote Side) to 6 (Quote Quantity Removed) for Quote Deletion due to Passive Liquidity Protection and Pending Cancellation Executed.

- T7: Enhanced Trading Interface - Derivatives Message Reference v.10.0-D0003

Published 4 Nov 2021 - This document provides a reference to all message formats for the Enhanced Trading Interface derivatives markets. (Please Note: This document is valid without changes for T7 Release 9.1 Simulation & Production.) - T7: Enhanced Trading Interface - Cash Message Reference v.10.0-C0003

Published 4 Nov 2021 - This document provides a reference to all message formats for the Enhanced Trading Interface cash markets. (Please Note: This document is valid without changes for T7 Release 9.1 Simulation & Production.) - T7 Release 10.0 Enhanced Trading Interface - XSD XML representation and layouts v.1.2

Published 4 Nov 2021 - The package contains the XML representation and the schema files for the Enhanced Trading Interface (ETI) for both the Cash and Derivatives Markets. (Please Note: This document is valid without changes for T7 Release 9.1 Simulation & Production.)

FIX Gateway

- T7 FIX Gateway Manual (FIX 4.4) v.10.0-1

Published 4 Nov 2021 - The document provides information on the T7 FIX Gateway for both the Cash and Derivatives Markets and contains a detailed description of the concepts and messages used by the interface. This document is only applicable for FIX version 4.4. - T7 FIX Gateway - FPL Repository v.10.0-1

Published 4 Nov 2021 - The FPL (FIX Protocol Language) repository contains the XML representation of the T7 FIX Gateway version 4.4 for both the Cash and Derivatives markets. - T7 FIX Gateway - Fiximate v.10.0-1

Published 4 Nov 2021 - The package provides a browser-based representation of the repository for the T7 FIX Gateway version 4.4 for both the Cash and Derivatives markets with navigation capabilities.

FIX LF

T7 Release 10.0 - FIX LF Manual v.1.2

Published 4 Nov 2021 - The document provides information on the T7 FIX LF interface for both the Cash and Derivatives Markets and contains a description of the conncectivity, concepts and messages used by FIX LF.T7: FIX LF Interface - Derivatives Message Reference v.10.0-D0002

Published 4 Nov 2021 - The purpose of this document is to provide all message formats for the derivatives markets part of the FIX LF interface.T7: FIX LF Interface - Cash Message Reference v.10.0-C0002

Published 4 Nov 2021 - The purpose of this document is to provide all message formats for the cash markets part of the FIX LF interface.T7 FIX LF QuickFix Engine Dictionary and Message Reference v.1.2

Published 4 Nov 2021 - The package contains the QuickFix Engine dictionaries (FIXLF44_Derivatives.xml, FIXLF44_Cash.xml) and message reference files including message and field descriptions (FIXLF_DerivativesExt.xml, FIXLF_CashExt.xml) for the T7 FIX LF interface per marketplace type.

- T7 Derivatives Markets - T7 Trader, Admin and Clearer GUI v.10.0.04

Published 4 Nov 2021 - This document provides information on the T7 Derivatives Markets GUI solutions, the Trader-, Admin- and Clearer GUI for T7. All views and functions of the T7 Derivatives Markets GUIs are described. - T7 Cash Markets - T7 Trader, Admin and Clearer GUI v.10.0.03

Published 4 Nov 2021 - This document provides information on the T7 Cash Markets GUI solutions, the Trader-, Admin- and Clearer GUI for T7. All views and functions of the T7 Cash Markets GUIs are described. - T7 Trader GUI, Admin GUI and Clearer GUI - Installation Manual v.10.0.1

Published 15 Dec 2021 - This document provides information on Deutsche Börse's T7 GUI solutions, the T7 Trader GUI, T7 Admin GUI and T7 Clearer GUI from a technical point of view. The document explains how to establish connection to Deutsche Börse's T7 with the GUI solutions. - T7 Derivatives Market Eurex - Participant and User Maintenance Manual v.1.0

Published 30 Aug 2021 - This manual is intended to assist service administrators who are responsible for maintaining participant and user related data in T7. - T7 Cash Markets - Xetra and Börse Frankfurt: Participant and User Maintenance Manual v.1.0

Published 30 Aug 2021 - This manual is intended to assist service administrators who are responsible for maintaining participant and user related data in T7.

Supporting Documents

Circulars

Participants Requirements

Changes | Details | Action Item |

ORS Trader flagging obligation | When an ORS is used by an admitted Exchange Trader, their own Member ID-Trader ID combination (e.g., ABCFRTRD001) must be submitted to the trading system of Eurex Deutschland via tag 2404 ‘ComplianceText’. Use cases for which identification obligation applies:

| All ORS providers and users must comply with the amended exchange rules and the associated identification obligation that will become effective for Exchange Participants as of 22 November 2021. |

Contact

Contact

Eurex Frankfurt AG

Key Account Management

Service times from 09:00 - 18:00 CET