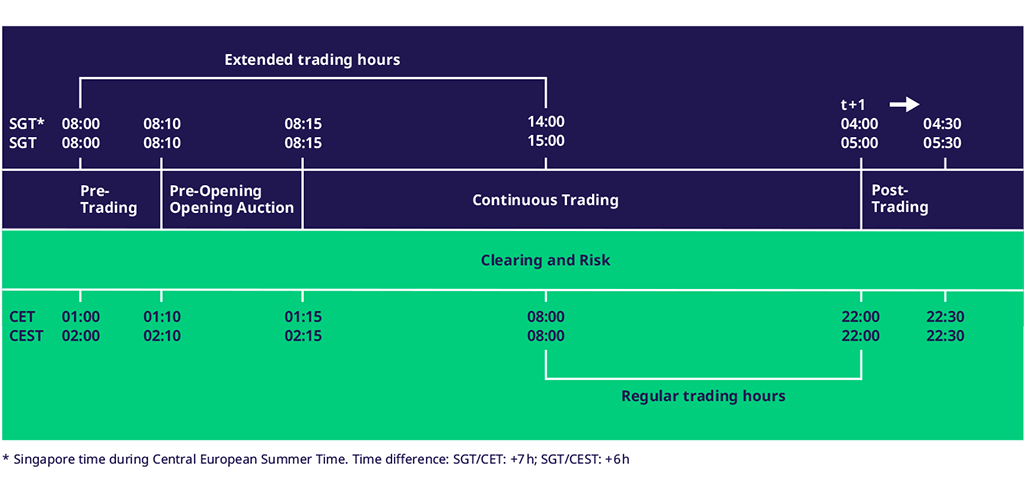

Trading phases

During the trading day, each product has a specific trading phase (state) that gives a structure to the business day.

The instrument state changes in general with the product state.

The following sub-chapters describe each product state in detail; in order to get more details about order restrictions, please see the sub-chapter Order restrictions by trading period.

Overview of content

Closing

The product state Closing is a short phase that sits between the phases Trading and Post-Trading. It covers the time between the end of regular trading and the end of the last auction.

In designated futures contracts, to establish a closing price, the trading period ends with a closing auction. All open orders and quotes are automatically carried over into the closing auction. New orders may be entered, and existing orders and quotes may be individually modified or cancelled. The auction principle applies during the closing auction; the daily closing price is the price at which the greatest possible volume can be matched in the respective contract.

If the potential closing price differs considerably from the reference price, based on previously prevailing market conditions, the closing auction may be aborted.

The closing auction with respect to a product shall end as soon as the netting process has been completed for all futures contracts based on that product.

If no market orders exist for any specific futures contracts and matching between limit orders and quotes is not possible, or if market orders exist that are not executable, the closing auction shall end without determining a closing price.