01 9月 2022

Eurex Asia

【新闻发布】Eurex KOSPI 衍生品交易量创纪录:自推出以来每周交易超过 300 万手期权

2022 年上半年,Eurex/ KRX Link 总交易量同比飙升 160%,累计交易合约接近 2000 万份

上市以来四个月内累计交易了超过 300 万份KOSPI 每周期权合约,6 月份日均交易量为83,000手;於2022 年 8 月 11 日,亚洲夜盘交易占比率达到 29.1% 的历史新高

在持续通胀和美元走强的情况下,美元兑韩元期货交易活动同比年增长 81% 至 2022 年日均交易量 达2,800手

迷你KOSPI 期货交易量持续增长,2022 年日交易量超过 8.7 万份合约,夜盘交易占比率上升 3.1 个百分点至 7.9%;在 5 月合约到期前,该期货合约的交易量也创下历史新高,单日交易量曾超过 22,000手

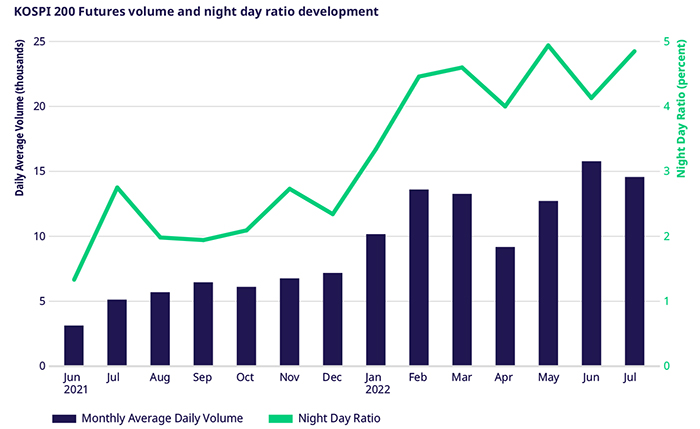

KOSPI 200 期货表现出持续增长,整个 2022 年月度ADV 稳步上升。2022 年 6 月日均交易量 ADV 达到 15,800 手,与 2021 年 6 月相比增长 403%

KOSPI 200 期货交易量与亚洲夜盘交易占比率发展

迷你KOSPI 200 期货交易量与亚洲夜盘交易占比率发展

KOSPI 200 期货交易量与亚洲夜盘交易占比率发展

KOSPI 200 每周期货交易量与亚洲夜盘交易占比率发展