欧洲期货交易所与韩国交易所产品链接

在KRX收盘后交易和对冲您韩国市场的风险敞口

以下一日到期期货可于欧洲和美国核心交易时段在Eurex进行交易:

- KOSPI 200期权

- Mini-KOSPI 200期货

- KOSPI 200期货

- 美元/韩元期货

- KOSPI 200每周期权(每周四到期)

- KOSPI 200每周期权(每周一到期)

事实证明,KRX和Eurex之间的战略合作对Eurex和KRX客户都极为有利。它将继续为两个交易所的市场参与者提供更多的交易和对冲机会。

Eurex / KRX 产品链接 — 2023/24年月份日均成交量 (以千为单位)

优势一览

- 在欧美时段、韩国市场收盘后交易KOSPI

KRX的KOSPI 200期权是世界上流动性最高的衍生产品之一。 Eurex KOSPI产品在核心欧洲和美国时区为市场参与者提供更多韩国指数的交易和对冲机会

- 有吸引力和流动性市场

交易活动持续增长,2021年Eurex KOSPI产品交易超过1900万手

- 完全可替代的产品

Eurex 挂牌的KOSPI 200产品可与KRX的相应合约完全替代,每天在Eurex收盘后未平仓口数将转移至KRX,并且客户可以继续交易

- 交易所的好处

欧洲期货交易所的标准化交易,清算和风险管理功能有助降低交易对手风险并提高保证金效率

交易时段

合约规范

Eurex KOSPI 200期货 1

最小变动单位 | 产品代码 | 交易时间 | 最后交易日 | |

合约乘数 | 价格 | |||

一个KOSPI 200期货合约 (KRW 250,000) | 0.05 點 | 欧洲中部时间

| 最后交易日为最终结算日。 | |

Eurex Mini-KOSPI期货1

最小变动单位 | 产品代码 | 交易时间 | 最后交易日 | |

合约乘数 | 价格 | |||

一個Mini-KOSPI 200期貨合約 | 0.02 點 | 欧洲中部时间

| 最后交易日为最终结算日。 | |

Eurex KOSPI 200期权

最小变动单位 | 产品代码 | 交易时间 | 最后交易日 | |

合约乘数 | 价格 | |||

一个KOSPI 200期权合约 | 当报价不小于10点时: 0.05 点

| 欧洲中部时间

| 最后交易日为最终结算日。 | |

Eurex KOSPI 200每周期权(每周四到期)

最小变动单位 | 产品代码 | 交易时间 | 最后交易日 | |

合约乘数 | 价格 | |||

一个KOSPI 200每周期权合约 | 当报价不小于10点时: 0.05 点

| OKW1/3/4/5 | 欧洲中部时间

| 最后交易日为最终结算日。 |

Eurex KOSPI 200每周期权(每周一到期)

最小变动单位 | 产品代码 | 交易时间 | 最后交易日 | |

合约乘数 | 价格 | |||

一个KOSPI 200每周期权合约 | 当报价不小于10点时: 0.05 点

| OKM1/ OKM2/ OKM3/ OKM4/ OKM5 | 欧洲中部时间

| 最后交易日为最终结算日。 |

1经CFTC核准

2欧洲中部夏令时间

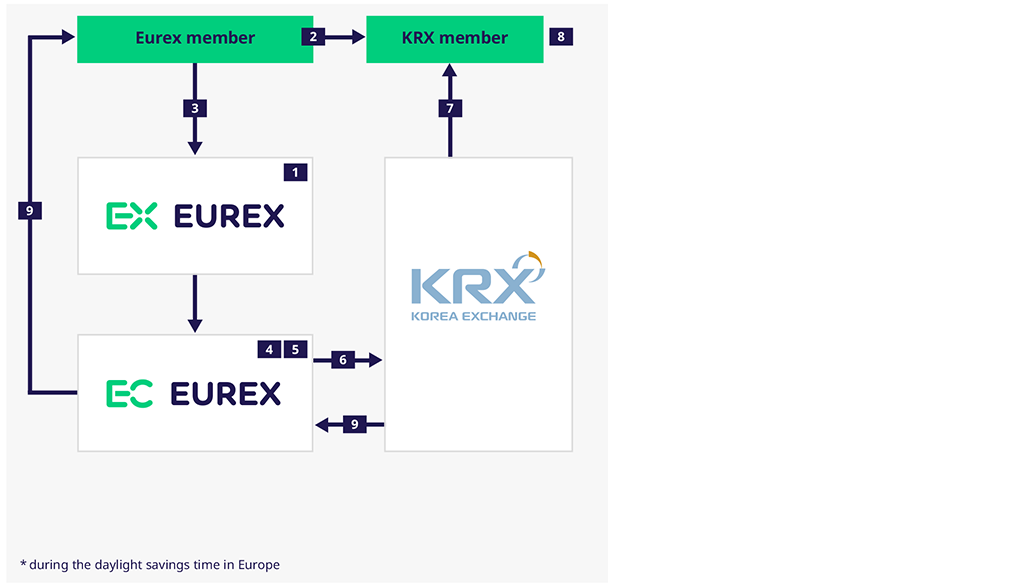

如何参与Eurex/KRX link

- 上市Eurex KOSPI 产品

- Eurex成员:必须与至少一位KRX成员建立业务关系,才能交付Eurex KOSPI的产品。KRX会员:至少与一位Eurex会员开设一个帐户,以便利韩国的对外订单来交易Eurex KOSPI产品

- Eurex会员可以通过指示KRX会员和最终受益人的ID帐号在Eurex上交易产品。 KRX会员通过Eurex会员交易Eurex KOSPI产品

- 保证金:欧洲期货交易所清算货币的日内保证金(欧元/瑞士法郎/美元/英镑)

- 结算:韩国结算银行在韩国标准时间 15:00 (中欧时间07:00 or 08:00*)前支付/接收韩元变异保证金

- 最终受益人从Eurex Clearing向KRX传输结算信息

- 从KRX向各自的KRX成员传输结算信息

- 保证金检查以及通过KRX的OTC大宗交易功能将结算信息输入KRX系统

- 确认结算信息,从而在KRX市场产生KOSPI 200期权/Mini KOSPI 200期货头寸

重要信息

Press Release | Eurex Asia

【新闻发布】欧交所和韩交所携手扩充全天候交易的KOSPI衍生品产品线

联系方式

Eurex 产品研发部 Sascha Semroch T +49 69 211-1 50 78 | Eurex 销售部

T +852 2530- 78 07 | KRX 国际销售部 |