Market-on-Close Futures

A listed solution for basis trading

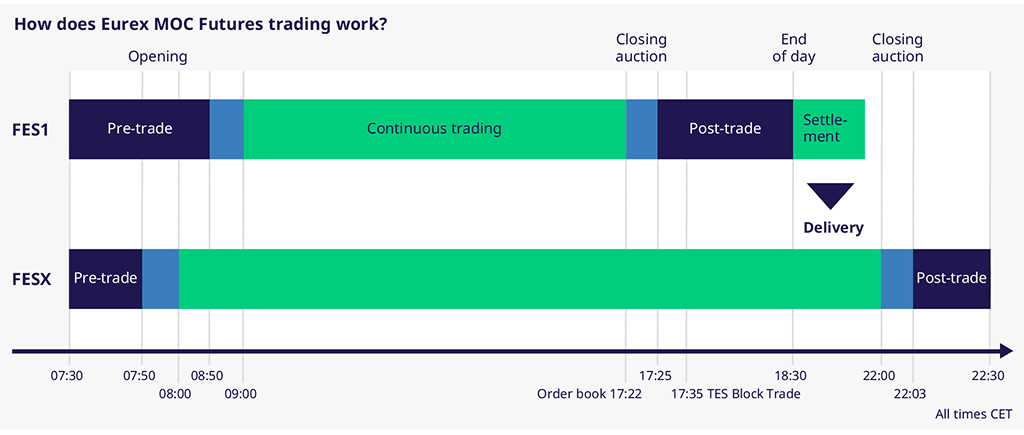

Eurex Market-on-Close Futures (Eurex MOC Futures) are designed to deliver multiple benefits to a market that, so far, has been dominated by OTC trading. Traditionally, basis, or market-on-close (MOC), trading requires high operational efforts with limited risk management opportunities as the basis is usually agreed on in the inter-dealer-broker market. While the basis is determined before the market close, the respective index futures trades must be entered into the Eurex® system after closing. This, amongst other harbors slippage costs.

In most cases, a MOC transaction has to be split into several trades as the final price (agreed basis plus index close level) is more granular than the index futures' tick size. That means that in order to enter them into TES Block Trade, MOC off-book transactions must be large enough in size to allow them to be split to achieve the desired final price.

By providing an on-exchange solution, Eurex supports MOC trading by futurizing basis trading in line with the regulatory agenda.

Key Benefits

- Cost-efficient:

Eurex MOC Futures only need one single execution to achieve the exact final futures price – eliminating slippage risk. - Easy to trade:

As an exchange-traded contract, Eurex MOC Futures offer traders the benefit of STP, thereby significantly reducing a trader's front office workload. - Easy to access:

Eurex MOC Futures can be traded at any size via the order book – the contract size can be adjusted in increments of one – or via TES Block Trade with a minimum size of 100 contracts. - Risk management included:

After the basis transaction, Eurex MOC Futures will be immediately included in the risk management system. - Provides transparency:

On-exchange trading offers immediate liquidity and public price information.

Need to know

Based on Europe’s top 50

Our first contract in this segment covers one of the most liquid index futures worldwide: the EURO STOXX 50® Index Futures. Click here for volumes and more.

More efficiency and less risk

Eurex MOC Futures were developed to facilitate basis trading, where OTC trading becomes difficult.

Block Liquidity Providers

| Company | Member ID | Contact | Phone number |

| DRW Investments (UK) Ltd. | LOTLO | Chadwick Miller | +44-20-7031-1369 |

Flow Traders | NEDAM | Institutional Trading | +31-20-799-6777 |

IMC Trading B.V. | INMAM | +31-20-798-8599 |

Execution Broker

| Company | Member ID | Contact | Phone number |

| GFI Securities Ltd | GFILO | Grégory Dumousseau | +33-17-670-35 52 |

| OTCex Group | PAFPA | Myles Dennigan | +44 207 959 0044 |

Vantage Capital | VCMLO | Vantage Execution | +44 203 107 5220 |

Prices/Quotes FES1

| Product | Diff. to prev. day last | Last price | Contracts | Time |

|---|---|---|---|---|

| FES1 | -0.47% | 5,728.00 | 555 | 18:34:15 |

Contacts

Floris Florquin T +44-20-78 62-76 62 |

Sophie Granchi T +33-0680347501 | Dorte Carlsen T +44-20-78 62-72 17 | Matthew Koren T +1-212-309-93 14 | Kris Hopkins T +65-65 97-30 61 |